Have a Cash Flow Problem? Here are 6 Usual Suspects

While there are many different causes as to why your business may have a cash flow problem, we’re diving into the top 6 reasons today.

We hope you had a bit of fun, maybe a bit of nostalgia, reading our last article that included the classic viral sensation Peanut Butter Jelly Time.

While the article was fun to write, it was a serious article in concept.

If you’re serious about wanting to manage your business and its cash flow, then you need to include the Statement of Cash Flows as part of your monthly business review and analysis, in conjunction with your P&L and Balance Sheet.

As a business owner, do you often feel like your cash flow balance is not representative of your profitability?

The Statement of Cash Flows helps explain the story of how your profit level translated to an increase or decrease in your cash flow balance.

While there are many different causes as to why your cash flow doesn’t align with your P&L, here are 6 usual suspects for small businesses:

- Your business sales are growing or declining

- Paying your vendors slower or faster

- Customers paying you slower or faster

- Buying furniture, fixtures vehicles and/or equipment

- Borrowing or paying down debt

- Contributing cash or taking a draw/distribution of cash from the business

Cash Flow Problem #1:

Your business is growing or declining

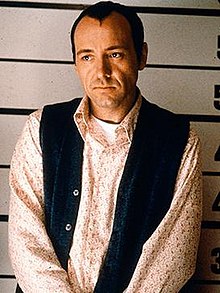

If I could make one reference to the movie The Usual Suspects, then it would be that this suspect is the Verbal/Keyser Söze of suspects.

It is like Verbal in the lineup with the other suspects: you forget about it because it’s in the background, it doesn’t appear menacing, but it ends up being the prime suspect and reason.

Your business growth or decline could be from a simple seasonality issue, or it could stem from actual growth or decline in your period-over-period sales levels.

Business owners often forget about the cash flow delay when growing a business since (for majority of businesses) customer collections occur 30-45 days or after a sale is made, and you typically have to procure and pay for the related expenses before this happens. Not to mention that you always need to set aside money for taxes.

Growing a business will hurt your cash flow, and depending upon your profit margin (assumed range of 5% to 25%), it could take from 12 months to 60 months (yes, 1-5 years) to see positive cash flow from growing your top line sales.

This 1-5 years is impacted by your specific industry so you may be lucky enough to collect customer deposits, which drastically changes this picture.

On the other hand, if your business is declining, then you should typically see an increase in your cash flow.

This often leads business owners to be more optimistic about their business as they see cash flow increasing and think their business must be doing better as well.

Cash Flow Problem #2:

Paying your vendors slower or faster

It happens all the time.

Business owners want to keep their suppliers happy and they feel like paying them faster will do this.

Sure, your supplier will like you, but they will also like you for just paying on time.

If they wanted the money faster, they would have shorter payment terms or offer discounts for getting paid early.

Stop doing this!! Pay your suppliers on time according to terms. All they really care about is that you never miss a payment.

On the other hand, you could be paying your vendors late.

Your cash flow is so tight that you have decided to slow down paying your suppliers until they call and ask for payment to stretch out your cash flow.

Cash Flow Problem #3:

Customers are paying you slower or faster

Usually customers do not pay you faster, unless they have decided to take advantage of an early pay discount you provide, or you finally paid attention to your cash flows and saw that customers were not paying on time and initiated better processes in your accounts receivable department.

(Hint: we strongly recommend automatic reminders and electronic collection methods!)

Customers paying you slower is usually the culprit and happens for a few reasons.

Typically, they are having cash flow issues, or they simply forgot.

In either case, customers will pay those first who communicate the importance of paying on time, and those who continue to remind them of of overdue payments.

Think about it, if you had cash flow issues, would you pay a supplier who never reaches out to you? Or are you going to pay the supplier who sends reminders, overdue notices, and shipment halts on future orders until payments are made.

You need to do the same with your customers.

Cash Flow Problem #4:

Buying or selling furniture, fixtures, vehicles, and/or equipment

It’s not on the P&L yet, but you forgot that you bought or sold an asset of the company.

The sale of an asset usually does not bring much money, so the most likely culprit here is the purchase of a new asset.

Hopefully, the cost of this asset is offset by the inflow of cash from a bank loan used to purchase the asset, as you correctly used long-term financing to purchase a long-term asset so you could conserve your working capital for operations, not investments.

Cash Flow Problem #5:

Borrowing or paying down debt

Purchased a new asset with debt? Borrowed money on your line of credit? Did you pay down any loans or leases? Again, these won’t show up on the P&L.

You will see the balance of the loans appear on the Balance Sheet, but the Statement of Cash Flows will show you the inflow/outflow of debt.

Cash Flow Problem #6:

Contributing cash or taking a draw/distribution of cash from the business

As a business owner, you can pay yourself in the form of wages/guaranteed payments and in draws/distributions.

Wages and guaranteed payments show up on your P&L as an expense, but your draws/distributions do not.

The cumulative balance will appear on the Balance Sheet, but any amount taken out during the period will appear on your Statement of Cash Flows

Or instead of taking distributions out of your business, you could have invested or loaned the company money.

Contact U-nique Accounting for Assistance

Do you need help figuring out where your cash flow problems lie?

We are experienced in helping small business owners pinpoint and fix their cash flow problems. Check out our cash flow management page or book a quick call to see if we can help.

Until next time.