How to Create a Business Budget 2023 (Top-Down Approach)

In today’s post, we’re going to walk you step-by-step through the process of creating a business budget for 2023.

The method of this article is the traditional top-down method used by most business owners due to its simplicity. If you want to know more about how to budget using the bottom-up approach (our preferred approach), please stay tuned for our upcoming post.

It’s that time of year again.

The time of year where you pour yourself a big cup of coffee (or wine), pull out your P&L, and start planning your company’s financial performance for the year ahead.

Some people might call this a ‘budget’, but don’t let that put you off.

A budget is one of the best tools a business owner can use to achieve and surpass business goals each year.

It helps you understand where your business is headed over the next month, quarter, or year, and mitigate inherent risk through appropriate planning. It also helps set controls around your spending, and will determine what your overhead recapture rate should be in your pricing model for the next year.

In today’s post, we’re going to walk step-by-step through how to create a top-down approach budget for your business in 2023, and a few of our tips along the way.

You can skip ahead to a section you’re interested in:

- Start with your previous income statement

- Set targets for revenue

- Review your margins

- Plan for cost reduction

- Create a provision and watch the cash flow

- Free Sample Budget

Otherwise, let’s dive in.

1. Start with your Previous Income Statement

If you’re currently sitting down with a big beverage and the current year’s P&L, you’ve nailed the first step.

As a starting point, touch base with your current financial performance.

- What revenue did you bring in this year?

- How much did you spend?

- Did you control your labor appropriately?

- Do you see any patterns?

- What unexpected expenses hurt you at the time?

- Where are most of your costs coming from?

These are all critical insights to analyze, and most importantly, will help you create a starting point for the budget next year.

2. Set Targets for Revenue

In a top-down approach, always start with your revenue targets first.

Look at your trailing 12 months of revenue and consider any catalysts that will grow or shrink this number in the coming year.

- Are you growing 10% each month?

- Have you hit a plateau and are at risk of losing valuable customers?

Use this year’s revenue numbers as a baseline and plot out the targets for next year, taking into consideration your inside knowledge as a business owner.

Note: A budget is not a wish list. Be realistic – even conservative – with your estimates. It’s better to undersell your revenue than oversell.

And here’s the thing—your estimation is going to be wrong 100% of the time, so don’t try to make it perfect. Revenue targets are going to veer off course to some degree due to variables beyond your control.

It’s normal!

The important part is to have a starting point that you can monitor and change as you go.

Remember to factor in the effects of seasonality (and other variables you can think of) that could impact your revenue.

Once you have a number you can feel confident with, move on to the next step.

3. Review Your Margins

There are two ways to increase your gross profit: increase your pricing or reduce your costs.

We talk a bit more about increasing profitability for 2023 in a recent blog post here.

In this step, we’re going to take a look at production costs – both fixed and variable – and see if there is room to bring costs down.

Let’s look at their definitions first.

Fixed Costs

Fixed costs are expenses that do not change based on production levels. This does not mean these expenses are written in stone—sometimes rent goes up or insurance premiums go down. Rather, it means that the cost doesn’t change based on the number of items you make.

Here are a few examples of fixed costs:

- Salaries

- Insurance premiums

- Depreciation on operating equipment

Variable Costs

Alternatively, variable costs are costs that you only pay for in order to produce goods – such as the cost of materials, or wages for the labor required to create or assemble the product.

Other examples of variable costs include:

- Cost of inventory

- Supplies

- Shipping costs

While it can be hard to fight for lower material costs (usually goes the opposite way), tracking its changes and ensuring that price markups are appropriate will help you maintain a healthy margin.

Additionally, managing lead times and capacity planning can help significantly minimize labor costs, by spreading work appropriately over your workforce shifts – at their normal pay rates – in order to reduce overtime pay.

4. Plan for SG&A (Selling, General and Administrative) Cost Reduction

Along with production costs, it’s a good time to plan for a reduction in all general costs as well – better known as your SG&A (Selling, General & Administrative) expenses.

SG&A expenses are expenditures that are not directly tied to a product, such as overhead costs, and are typically included under operating expenses as a separate line item.

Examples include:

- Salaries (staff, officers, salespeople)

- Insurance premiums

- Depreciation on office equipment

- Rent

- Sales and marketing costs

- Advertising

- Commissions

- Office supplies

- Legal costs

We recommend working with your accountant to see which of these line items can be decreased with ease.

Trust us, there are always areas within your operating expenses that can be reduced.

Additionally, if you have not price-checked your vendors in a while, it’s a good time to do so.

Get into the practice of checking quotes every so often to ensure you are always getting a fair deal from your current suppliers.

5. Create provisions and watch your cash flow

So, you now have estimated figures for revenue, expenses, and profit (revenue – expenses).

There’s just one piece missing from your budget—a provision for contingencies.

Growth doesn’t come cheap. If you are planning (and budgeting) for growth next year, your P&L won’t show the additional working capital reserves you’ll need to fund that growth.

We recommend adding a working capital reserve line into your budget to stow away cash for this very reason.

You can use this line to fund your growth and manage any emergencies or unexpected marketplace swings (COVID-19 anyone?) for next year.

Here at U-Nique Accounting, we place a heavy emphasis on monitoring cash flow and working capital reserves in order to make sure the business always has enough money to run and grow.

There are ways to preserve and accumulate cash by simply negotiating better terms with your vendors, offering fewer days of credit to customers, and fine-tuning your expenses each month.

We go into further detail about improving cash flow in our great new guide, How to Keep More Cash In Your Bank Account. You can check it out here.

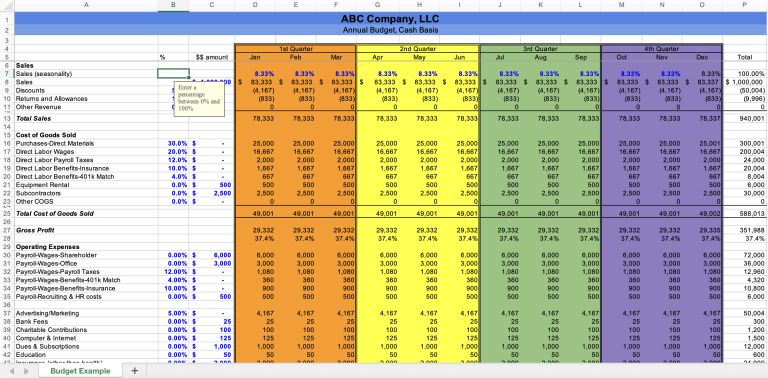

Use Our Free Budget Template

Well, there you have it. A quick and easy guide to creating your own top-down approach business budget for 2023.

To make things even easier, we created a Sample Budget Template for you to download and use in your business for next year.

Download Business Budget Template

How easy is that?

If you need extra assistance, don’t hesitate to reach out by scheduling a complimentary 15-minute call on our calendar.

We’re here to help businesses like yours improve cash flow and hit milestone financial goals year-on-year.

Simply book your call here:

Book 15-Min Call

Until next time!