Your Guide To The FICA Tip Credit 2025: How Restaurants Can Save $$$

After two years of closed restaurants, bars, and other food & beverage establishments due to a global pandemic, hospitality businesses could all use a little love… err… money, couldn’t they?

In today’s blog, we’re going to share one of our favorite tax credits for restaurants, bars and breweries: the FICA Tip Credit.

Let me start off with some strong words of advice. If you own and operate a bar/restaurant/brewery and your accountant is not taking advantage of the FICA Tip Credit on your tax returns, then you are losing out on tens of thousands of dollars of tax credits, every year. There is no room for grace/slack here with a bad professional. Ditch them as fast as possible and please find yourself a better accountant as the benefits will outweigh the increase in fees.

In fact, this article was a direct result of a new client we picked up on the west coast. They have been operating a bar for over 5 years that generates around $500,000/yr of revenue, and never claimed this credit. Their accountant made them miss out on about $60,000 of tax credits. Luckily we can amend a few years, but more than half of this credit is permanently lost.

So what is the FICA Tip Credit? Essentially the FICA Tip Credit is free money from the government that you can claim back based on the amount of tips that your employees report.

We’ll break it all down for you below.

What is FICA?

Let’s start out with an explanation of an acronym that you’re going to see a lot throughout this blog: FICA.

FICA is the federal payroll tax in the United States.

At every paycheck, the government deducts money from both the employer and employee, and puts it towards the federal funding of Social Security and Medicare.

Since 1990, the employee’s share of the Social Security portion of the FICA tax has been 6.2% of gross compensation (up to a limit) and 1.45% for Medicare tax.

The employer is also liable for 6.2% Social Security and 1.45% Medicare taxes.

It’s important to note that every business in the United States pays FICA – even solo-entrepreneurs.

What Is The FICA Tip Credit?

So, now that we know what FICA stands for, what is the FICA Tip Credit?

Essentially, the FICA Tip Credit is a way for the government to cut restaurants & bars a break on the tax that’s owed on tips.

Before the credit was enacted, the IRS estimated that about 15% of tip income was reported. By eliminating the tax that typically comes with income (i.e. tips), the FICA Tip Credit was designed to theoretically deter businesses from hiding or underreporting tip income.

Without the FICA Tip Credit, your restaurant, bar or brewery may end up paying a huge sum of payroll tax, due to the generous tipping of patrons.

It’s a HUGE tax break and it’s important to claim the credit every year – even if you don’t think it will make a difference.

Any unused credit can be carried forward up to 20 years until it’s completely utilized.

Does My Business Qualify For The FICA Tip Credit?

There are only 2 requirements:

- Your employees received tips from customers for providing, delivering, or serving food/beverages for consumption, where tipping is customary

- Your business paid/incurred employer social security and medicare taxes on those tips

Sweet! I Qualify. How Can I Tell If I Am Already Utilizing the FICA Tip Credit?

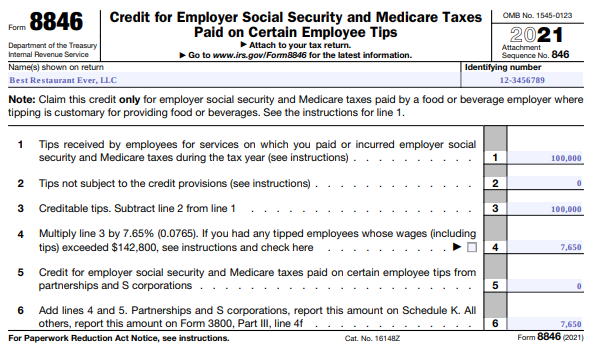

Your business tax return should include IRS form 8846 Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips. If you do not see this form, then you are missing out!!!

How-to Calculate The FICA Tip Credit

When it comes to calculating how much your food & beverage business can save through the FICA Tip Credit, An experienced accountant will be able to run the figures accurately for you, and can pick up greater tax incentives that a non-professional won’t spot. (Or so they should… )

If you don’t have an experienced accountant you’re happy with, you can book a complimentary call with one of our accountants anytime.

For the purposes of a simplistic calculation, you can claim the FICA tip credit up to the amount of your portion of FICA taxes that are paid on your employee’s income in excess of the federal minimum wage – $5.15 (YES, you read this correctly. The FICA tip credit still uses the federal minimum wage threshold that was set back when the credit was enacted).

In layman’s terms? With today’s higher minimum wage threshold, you will receive the FICA tip credit on 100% of all reported tips.

As you can imagine, this can equal thousands of dollars for food & beverage establishments at the end of the year.

How to Take Advantage of the FICA Tip Credit in 2025

To physically take advantage of the FICA Tip Credit in 2025, you’ll need to fill out Form 8846: The Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips during your year-end tax filing. (You can also amend previously filed tax returns)

The best thing to do? Get in touch with a good accountant.

It’s too important of a tax credit to miscalculate or worse, miss altogether.

An experienced accountant can help your restaurant, bar or brewery save thousands of dollars in payroll taxes, and will more than offset the increased fees of using a better accountant.

It’s well worth the chat to find out how much they can save for yours.

Until next time!