A Simple Balance Sheet For Breweries (Template)

With over 9,900 breweries across the US alone in 2023, breweries are obviously a market teeming with opportunity.

But just like any good brew, success requires more than just quality ingredients and a catchy name. Running a brewery is a complex dance between passion and profit margins.

That’s where a solid understanding of your brewery’s financial health is called for. Just like a perfectly hopped pale ale, your finances need balance.

In this article, we’ll walk you through one of the basic financial statements called a Balance Sheet.

First, what is a Balance Sheet?

A Balance Sheet is a financial statement that provides a summary of what your brewery owns (assets), what it owes (liabilities), and the owner’s equity at a specific point in time.

As an accounting rule, your assets should always equal the total of your liabilities and equity; hence the name “balance” sheet.

For the sake of clarity, let’s put that in equation form, as this is foundational to understanding how this financial document works:

Assets = Liabilities + Owner’s Equity

This might sound complicated but it’s actually pretty intuitive, since anything that your business owns (for example, a machine which is an asset) is practically financed either by the money you’ve put up for the business (equity) or by money borrowed somewhere else (liabilities).

Components of a Balance Sheet for Breweries

Assets

Assets are the things your brewery owns that can be used to generate income for the business. In a Balance Sheet, assets are grouped based on their sub-classification, whether current or noncurrent.

Current assets are those that can be converted into cash within a span of a year. These include cash, accounts receivable, and inventory.

Conversely, noncurrent assets are those that cannot be easily converted to cash in a single year. Examples of these are your brewery equipment, building, land, and trademarks.

Liabilities

These are the debts or obligations that your brewery owes. Just like assets, they are further classified into current and noncurrent liabilities.

Current liabilities are obligations that need to be settled within a year, just like your accounts payable to suppliers and short-term loans.

On the other hand, if they’re due beyond one year, they’re called noncurrent liabilities. These include long-term loans for big investments like property or other major equipment and mortgages for the building where your brewery operates.

Owner’s Equity

This represents what you’ve invested for the business or what we commonly call “capital,” alongside any profits that have been reinvested while in operation (retained earnings).

Putting It All Together

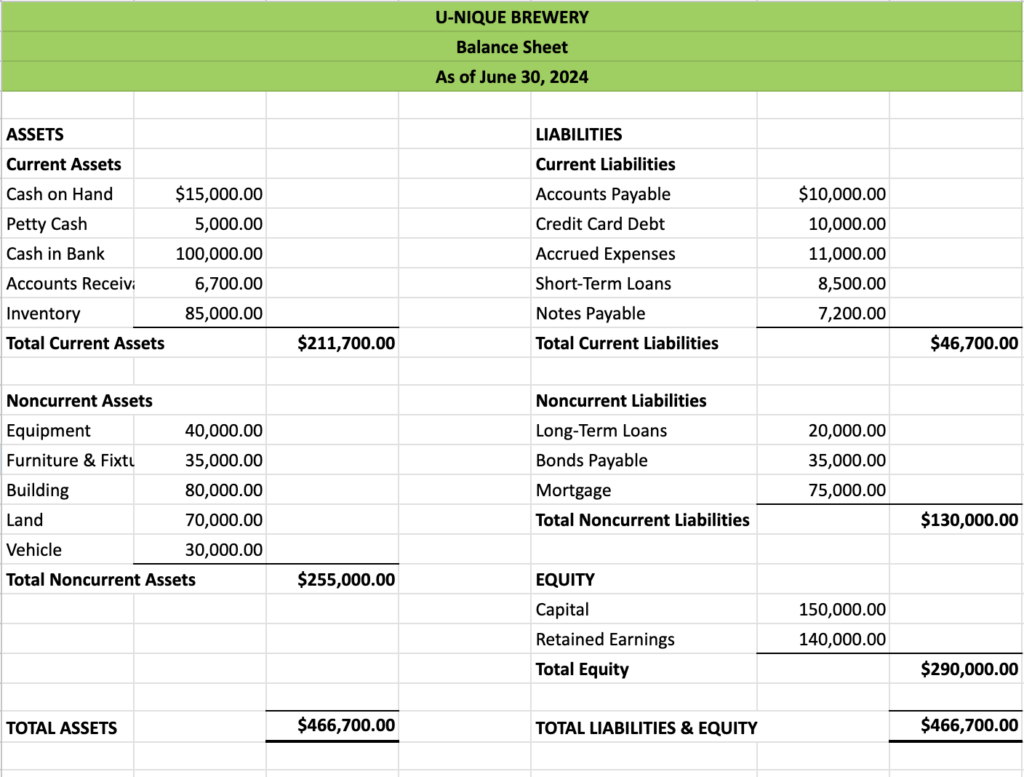

Now that you have a grasp of what composes a Balance Sheet, let’s look into a sample template of how a Balance Sheet for a brewery might look like:

Know Your Numbers: Analyzing the Balance Sheet

Understanding the Balance Sheet will equip you to make informed decisions about critical plans like expanding, hunting for new investors, or even ensuring that your day-to-day operations are bubbling smoothly.

To properly analyze your Balance Sheet, start by regularly reviewing it to familiarize yourself with the usual financial patterns so that it’s easier to spot irregularities before they become problems.

For example, if your liabilities are growing faster than your assets, it might signal that you’re taking on too much debt.

To ensure your cash flow has enough breathing room to meet short-term obligations, check how your current assets and current liabilities compare to each other.

For example, if you see that your accounts payable are always higher than your accounts receivable, you might need to tighten up your collection process or renegotiate payment terms with suppliers.

Next, pay attention to how noncurrent assets and noncurrent liabilities are stacked up against each other.

- Are your investments in brewing equipment and property generating the returns you expected?

- Are your long-term debts manageable, or do they need refinancing to better align with your cash flow and perhaps, save on better interest rates?

Owner’s equity is another crucial part of the equation. High retained earnings indicate a profitable business, but if you’re constantly reinvesting profits, ensure it’s leading to growth. Compare your equity over time to see how your investment is growing.

Unbalanced Balance Sheet

An unbalanced Balance Sheet is like brewing a batch with the wrong grain ratio—it just won’t produce a quality beer!

When your assets don’t match up with your liabilities and equity, it can be a major buzzkill for investors and lenders.

This imbalance could stem from accounting errors, missed entries, or deeper financial troubles.

To fix these imbalances, review your financial records carefully, ensuring all entries are accurate and complete.

Or better yet, save yourself from the hassle and leave the work to your trusty accountant. *winks*

Brewing Beers, Balancing Books

Let’s face it. Running a brewery and juggling the finances is already a tall order, and it gets even trickier when the Balance Sheet doesn’t balance.

So, while you continue to craft amazing brews, we have your back to help you balance the books and keep your finances in top shape.

We tailor our services specifically for breweries knowing the unique challenges and opportunities in this industry.

This is why we only use, and highly recommend, using Xero for your accounting. Xero’s ability to customize your financial reports (at no extra cost) to calculate and track your industry specific costs/ratios helps you properly analyze the financial performance of your business, so you can make timely and meaningful decisions.

Use the calendar below to schedule your first introductory call with our team or head over to our Getting Started page.

Until next time!

By MATT CIANCIARULO