Will Why the Balance Sheet Matters for Restaurants

The Balance Sheet is one of three crucial financial statements that every business uses to track performance & worth.

But what exactly does it show? And why is it particularly important for restaurant owners to pay attention to?

In this blog, we’re going to break down exactly what’s on a Balance Sheet and why you should be reviewing it as a restaurant owner each month.

Let’s talk Balance Sheet.

What is a Balance Sheet?

A Balance Sheet is a financial statement that provides a snapshot of a restaurant’s financial position at a specific point in time.

This is different from the P&L, or income statement, which shows how you are performing over a defined period of time.

The Balance Sheet presents information about your restaurant’s assets, liabilities, and equity, and essentially shows how healthy your finances are at any point in time.

Typically, it’s prepared at the end of set periods (e.g., every 4 weeks (see 13-period accounting method), every month, quarter, or annually).

What is on a Restaurant Balance Sheet?

The Balance Sheet is organized into two sections: The company’s assets, and the company’s liabilities and equity.

The Balance Sheet is called a “balance” sheet because the total assets must equal the total liabilities and equity.

This is known as the accounting equation and is represented as Assets = Liabilities + Equity.

The three categories make up the total resources available to your restaurant business, the debt the business owes, and your personal ownership in the business.

Let’s look at each category in more detail:

Assets

The simplest example is cash, actual money that your business can use to pay suppliers, the landlord, etc.

There are many different types of Assets, and they are presented on the Balance Sheet in order of their liquidity (how quickly they can be converted to cash).

Examples of assets that might appear on a balance sheet for a restaurant include cash (bank accounts, cash register, cash safe), receivables, inventory and equipment.

Liabilities

Think of Liabilities as the opposite of Assets. They are what you owe to other parties, and are presented on the Balance Sheet in order of how quickly they must be paid.

Examples of liabilities for a restaurant might include accounts payable, credit card balances, tips owed to employees, remaining gift card balances, taxes owed (sales/excise tax), and loans.

Equity

Out of the three, Equity is the trickiest to understand. It shows the amount of capital invested, and the cumulative amount of profits retained (undistributed) to owners.

Equity can also include other items such as stock options and warrants.

Let’s Look at a Simplified Balance Sheet for Restaurants

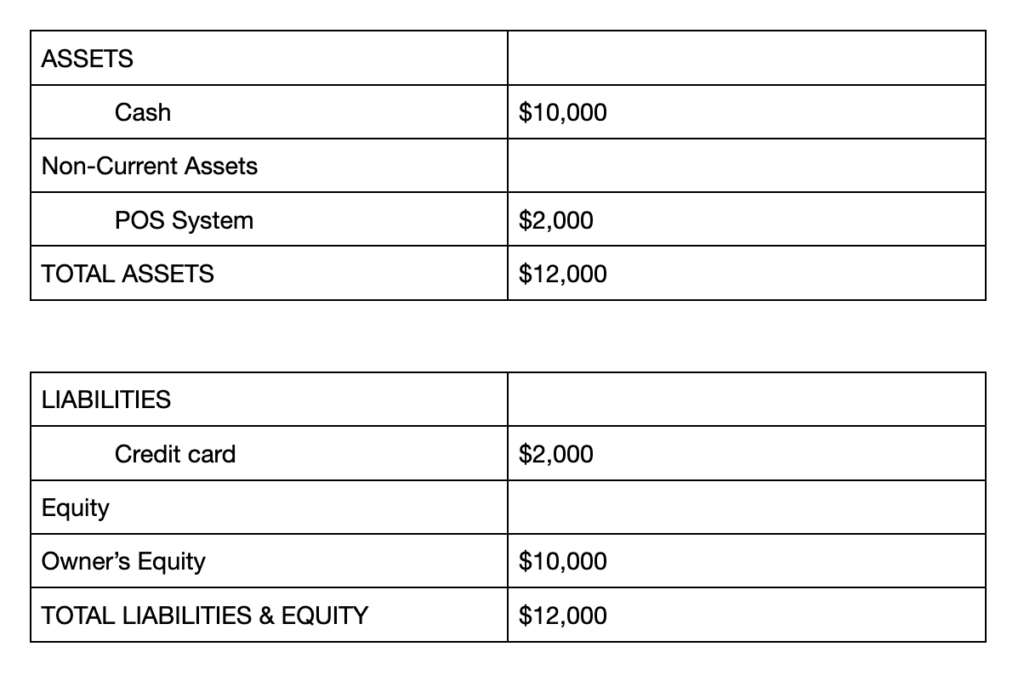

Let’s look at an example of a simplified restaurant balance sheet.

You’re just getting started and you put $10,000 into your restaurant as a sole owner.

Your ownership is 100% and you don’t owe money to anyone yet.

Your Equity is $10,000.

Now, let’s say you need to buy a POS system for $2,000 with your credit card.

The Balance Sheet will change to something like this:

As shown, you’re tracking the available resources to the company (cash + POS system), how much you owe ($2,000 to the credit card company), and how much you personally own ($10,000 of cash).

Why Is The Balance Sheet So Important to Restaurants?

While the Balance Sheet is important to monitor for every business owner, it’s particularly important for restaurant owners to track for a few reasons.

#1 The first reason is inventory.

One of the things that the Balance Sheet can tell you is how much inventory your restaurant has and how much it’s worth.

This is important because it can help you and your managers keep track of inventory levels and make sure that you’re not ordering too much or too little.

For example, if your restaurant has a lot of inventory that isn’t selling, you may need to adjust your menu or ordering practices to prevent waste. On the other hand, if you’re constantly running out of certain items, you may need to order more to meet demand.

By using the Balance Sheet to track inventory levels and values, you can better manage your costs and make sure that you’re not wasting money on unnecessary inventory.

#2 The next reason is fixed assets.

As you know, restaurants typically have a lot of fixed assets such as kitchen equipment, furniture, and fixtures.

These assets can be significant investments, and the Balance Sheet can help you and any investors track the value of these assets over time.

This can be useful for several reasons. For example, if you’re thinking about selling or upgrading any equipment, you can use the Balance Sheet to get an idea of how much you might be able to sell it for.

Investors, too, might be interested in the value of a restaurant’s fixed assets. If an investor is thinking about putting money into your restaurant, they’ll want to know what the restaurant is worth and what assets it has.

The Balance Sheet will provide that information and help investors make informed decisions.

#3 Finally, debt & payables.

Unlike other businesses, a restaurant collects a lot of money that does not belong to them, in the form of employee tips and sales tax collected from customers. Making sure you track these balances and pay them timely is of the utmost importance because if you don’t you will likely overspend money that doesn’t belong to you, which leaves your business with less than adequate funds to cover tips and taxes owed.

Plus, like any other business, you probably had to take out loans or other forms of debt to finance your restaurant operations,

The Balance Sheet can show how much debt the restaurant has in terms of unpaid employee tips, state tax liabilities, operating costs, and loans.

Knowing how much debt you have is important because it can impact your ability to grow.

Too much? You may struggle to make repayments. Not enough? You may not be able to take advantage of expansion or improvement opportunities.

We recommend working with an experienced restaurant accountant to determine the right amount of debt for your restaurant.

Need Help With Your Restaurant’s Balance Sheet?

Typically, the restaurant’s Balance Sheet is something that your accountant takes care of.

They will typically use information from the business’s financial records and transactions to create the Balance Sheet and update it regularly.

However, it’s important to note that while your accountant is responsible for preparing the balance sheet, you as a business owner should also understand and review it regularly.

This will help you make informed decisions about your business’s finances and identify any potential issues or opportunities for improvement.

If you don’t want an accountant who is experienced with restaurants, or you’re simply exploring your options, we’re always here to help.

You can jump on a quick 15-minute call with one of our restaurant accountants to help answer any questions you have.

Until next time!