Wire Transfer Processing Software: Stop paying excessive bank fees!

Out with the old and in with the new methods to save you money.

I was just having coffee with a prospect who buys products overseas and found out they do all their international wires through their bank. Yikes! Ouch!

Just thinking of all those years of excessive unnecessary fees that just ate away at their hard earned profits made me cringe.

Are you just like that prospect? Are you still sending and receiving wire transfers through your traditional bank account? If so, you are throwing away money on each transaction.

The traditional banking model utilizes an archaic method of moving money from one account to another by hopping money across the world through numerous banks, resulting in currency translation and other fees all along the way. Plus, banks charge fees to recuperate their own overhead costs on each transfer.

Well, I have some great news to share with those of you who are still using the outdated traditional method for wires. Today’s wire transfer processing softwares have simplified the transfer process by allowing direct transfers from 1 account directly to another. Since funds do not have to jump branch to branch, you incur less bank fees and currency translation fees for each and every wire transfer. In addition, since these companies have a completely different overhead structure compared to a traditional bank, they can charge zero to minimal fees to process the wire transfers.

U-Nique does not currently issue any wire payments, but popular programs used by our clients include the following:

•Wise (formerly transferwise) is a popular option.

• Veem is another alternative. (Veem also partners with accountants so they can have access to your account without having to add them as a user, giving them visibility to your vendor payments and the ability to submit payments on your behalf, if needed.)

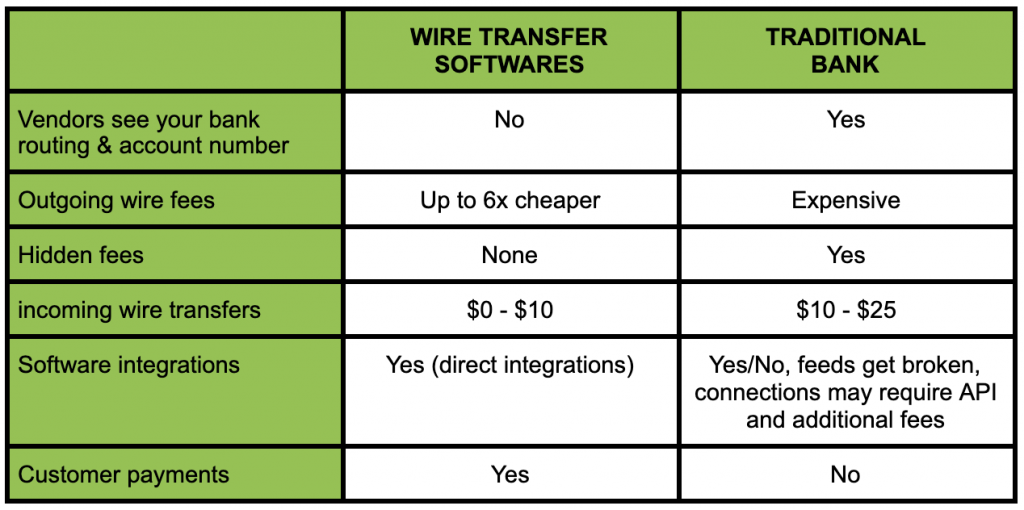

Here is a quick comparison of the traditional vs. newer model of wire transfers: