Which is better for a business in need of cash – using a line of credit or business factoring? Besides Factoring being an asset-based transaction vs. the revolving loan of a credit line, here are other factors (pun intended) you should consider as well.

Cost

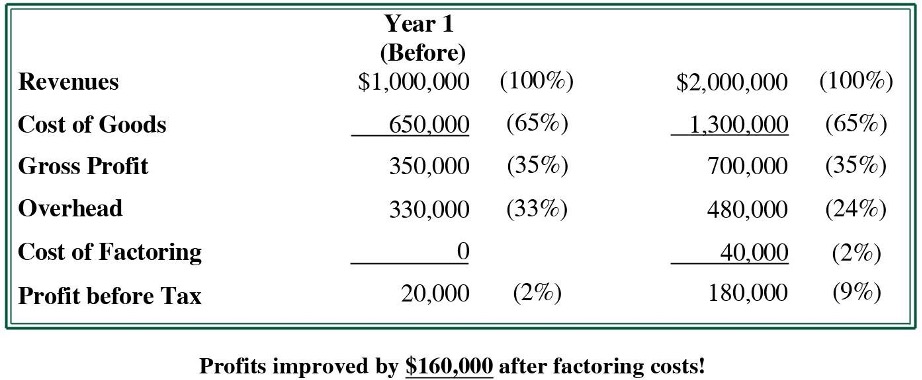

A Factor’s discount rate is generally less expensive than the interest rate of a business credit line. Especially if your company is hardly the darling of credit providers or has a relatively high-profit margin.

The creditworthiness of your customers and NOT your business is one of the first things a Factor looks at. How long does this customer usually take to pay? Partial or full payments? The rosier the credit checks on your customers, the sweeter the discount rate is for you. The due date plus the value of an invoice also comes into play. While some Factors offer discounts only for due dates of up to 60 days, others charge a higher rate for anything beyond.

On the other hand, depending on the loan amount, repayment term, collateral pledge and your firm’s credit score, a business line of credit can set you back by quite a lot. Traditional banks will offer an APR of Libor/SOFR + a few basis points, while non-traditional banks can get expensive. These rates can typically range up to 60%, but some can be even higher.

Maintenance

Many factoring lines are low-maintenance and extend quite naturally from your normal operations. All you need is common business sense to keep a factoring line going – work with reliable customers that pay on time and keep your business as a going concern.

Maintaining a line of credit can be more onerous. That’s because most come with covenants such as detailed financial records, healthy financial ratios, and a certain level of corporate net worth or market value.

Needless to say, these tend to favor larger, rather than smaller, companies.

Line increase

Again, a line increase for factoring is pretty straightforward. Because it often means you are sending out more invoices to an expanding customer base for a growing business. It’s a clear win-win because a Factor stands to profit directly from yours, as long as your new customers are good, paying ones.

But not as much when it comes to increasing a credit line. Even when your tills are ringing louder and faster, a lender would want to look again at your cash flow, assets, or even the entire financials. Some could demand a larger collateral when the equivalent for factoring is simply the accounts receivable themselves.