Cash Flow Forecasting 101: What It Is & Why You Should Be Doing It

If you have a growing business, or are looking to grow it, I strongly encourage you to implement the process of cash flow forecasting within your business.

When done properly, cash flow forecasting will become one of the most important tools in your financial tool belt for helping run your company.

What Is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating the flow of cash in and out of your business.

It’s different to a budget, which we go over in more detail over here.

Unlike a budget, a cash flow forecast is a continual process that requires review and analysis consistently throughout the life of your business.

It’s not a one-hour activity!

In fact, creating a proper forecast takes a great deal of effort.

It requires time and effort from your team members. It requires analysis of historical and current data, economic and marketplace trends. And it requires skilled estimating and much, much more.

Cash Flow Forecasting: Dynamic vs. Static

While forecasts can come with a variety of labels, we’re going to focus on two different types of forecasts in today’s blog:

- Static/stationary forecast, and

- Dynamic forecast

Dynamic means continuous change, while static (stationary) implies that it is fixed, unchanging.

If you’ve read any of our prior budgeting articles, you can probably guess which one I recommend doing.

A static forecast, in essence, acts exactly like a budget as it is never updated or changed based on external factors.

Tip: A static forecast is a waste of your time as a business performance tool.

So, via process of elimination you can probably guess at this point that I recommend the dynamic forecasting process, which is what we’re going to dive deeper into today.

Dynamic Cash Flow Forecasting Steps

To make a forecast a true dynamic business tool, it has to be consistently updated.

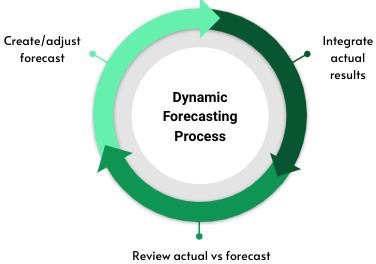

In a dynamic forecasting process, these are the steps you’ll follow:

- Create your baseline forecast

- Integrate actual results as they occur

- Analyze actual results vs forecasted results to help adjust future forecast assumptions

- Repeat this process all over again next financial month end

It is a circular process that repeats over and over again. In this manner, your “estimate” of what you hope is likely to occur in the future is as realistic as you can possibly make it, so that it becomes a reliable business tool.

Is a P&L or Income Statement Forecast Good Enough?

No!

While a P&L forecast is a starting point, it is only one part of a complete business forecast.

Remember, the main purpose for setting up a forecast is to predict the future cash flows of your company so you can make extremely important decisions regarding your company’s growth or downsizing.

And, this is why a true business forecast encompasses the entire set of your company’s finances.

This means you should have a forecasted Profit & Loss Statement, Balance Sheet, and Statement of Cash Flows.

Yes, I am 100% serious about that.

I have been reviewing and fixing other professionals’ cash flow forecasts for the majority of my career.

Unless there is a Balance Sheet, Income Statement and Statement of Cash Flows, where you can verify that all estimated debit and credits have been accounted for, there is too much room for error and inaccurate forecasted results.

And friends, that is dangerous because you are RELYING on these BAD ASSUMPTIONS to make EXTREMELY IMPORTANT business decisions.

Where To Start With Cash Flow Forecasting

Hopefully I didn’t scare you with how complicated this sounds, but don’t worry because no one is asking you to do the heavy lifting; that is what a good virtual CFO is for, and why they are a business owner’s #1 trusted advisor.

Your trusted advisor should help create and drive this process for your company.

This living, breathing business tool will become a necessary part of the analysis of your company so you can see

- Where your company is headed

- Will there be bumps along the way?

- Can you afford the debt you have?

- Do you have capacity to take on more debt?

- Can you afford to expand your business?

- When will you need to hire more employees?

- And much, much more

If you have a growing business, or are looking to grow it, I strongly encourage you to implement the process of cash flow forecasting within your business.

Once it is set up and becomes a reliable decision making tool, you won’t believe you ran your business without one.