What is on a Balance Sheet?

The Balance Sheet is one of three crucial financial statements that every business uses to track performance & worth.

But what exactly does it show?

In this blog, we’re going to break down exactly what’s on a Balance Sheet, how it’s calculated, and why you should be reviewing it as a business owner each month.

Let’s dive in.

What Is The Balance Sheet?

Unlike an Income Statement (which represents a company’s results over a defined period of time), a Balance Sheet is a “snapshot” in time that shows the business’s Assets, Liabilities, and Owner’s Equity as of a specific date.

In short, it helps to determine the financial health of the company.

Typically, it’s prepared at the end of set periods (e.g., every month, quarter, annually).

What is the Difference Between the P&L and Balance Sheet?

The Profit & Loss Statement (P&L) tells us how much money the company has made (or lost) during a period of time in terms of revenue and expenses. The Balance Sheet on the other hand shows the cumulative effect of all business transactions as of a specific point in time.

Think of it like brewing and selling a batch of beer. You need specific units of water, hops, grain, yeast, etc (ingredients), labor hours, and other misc. costs. You then sell the batch one pint at a time. The total sales received less the costs to brew and sell the beer is your net profit and is showcased on the Income Statement.

However, in order to even get to the point to brew the beer you needed money (in the form of capital contributed by investors or borrowed in the form of debt) so you could have money to invest in inventory, apparel, brewery tanks and other equipment, etc. All of this type of activity is reflected on your Balance Sheet.

While not as popular as the Profit & Loss Statement (P&L), the Balance Sheet is equally important to review on an ongoing basis. Banks will look at your Balance Sheet when you apply for a business loan, and investors will scrutinize it during due diligence to determine the company’s current and expected financial health.

What is on a Balance Sheet?

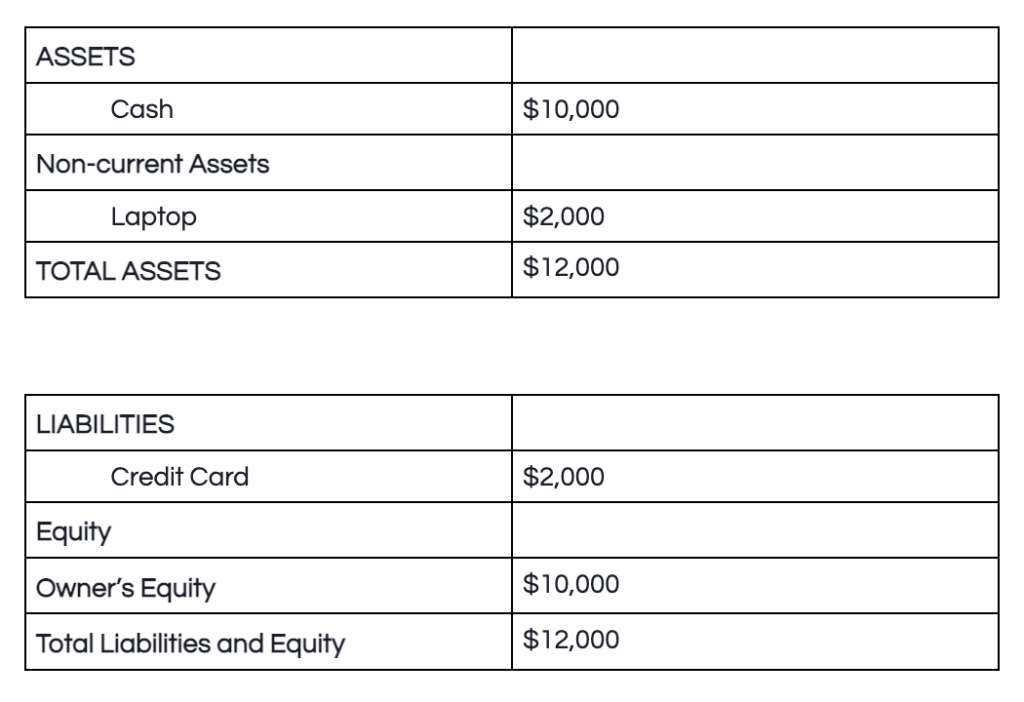

There are three main categories on every Balance Sheet: Assets, Liabilities, and Equity.

The three categories make up the total resources available to your business, the debt the business owes, and your personal ownership in the business.

Here’s the formula:

Assets = Liabilities + Equity

Assets

The simplest example is cash, actual money that your business can use to pay suppliers, the landlord, etc.

There are many different types of Assets, and they are presented on the Balance Sheet in order of their liquidity (how quickly it can be converted to cash).

Aside from cash, Assets can be:

- Customer receivables

- Inventory

- Vehicles

- Equipment

- Land and real estate

- Patents

- Stock in other businesses

- Security deposits

Liabilities

Examples of Liabilities are:

- Accounts payable (money owed to suppliers)

- Credit card balances

- Customer deposits

- Payroll Liabilities

- Interest and notes payable (mortgage, long-term loans)

Equity

Examples of Equity are:

- Stock

- Additional-Paid-In-Capital

- Distributions/Draws

- Retained Earnings

Out of the three, Equity is the trickiest to understand. It refers to the amount of the business that you (and any other owners) own.

As shown, you’re tracking the available resources to the company (cash + laptop), how much you owe ($2,000 to the credit card company), and how much you personally own ($10,000 of cash).

Need Help With Your Balance Sheet?

Are things still not clicking with the Balance Sheet, or are you simply too short on time to track the performance of your business as you should be?

That’s where we come in. (Or any other smart, experienced, funny, charming accountants you can find.)

Book a quick 15-minute call to see how we can help get your financial ducks in a row and point you in a better direction.

We’re here to help!

Until next time.