3 Questions to Ask Your Restaurant Accountant

You might be wondering if your accountant is truly doing a good job but aren’t sure how to assess it.

They handle your taxes each year, check in with you occasionally, and that’s about it.

But could they be missing out on opportunities that are costing you tens of thousands of dollars each year?

Is your restaurant potentially better off with a different firm?

To help you figure this out, we’ve put together 3 important questions to ask your accountant. These questions will help you see if they truly understand the restaurant industry and if they’re doing everything they can to save you money.

Let’s start with the first one.

Does your restaurant accountant use the 13-period calendar?

The first important question to ask your restaurant accountant is which calendar period they use for your financials.

Spoiler alert: It shouldn’t be the 12-month calendar most of us are familiar with in the United States if you’re in the restaurant industry.

The typical 12-month calendar we use, known as the Gregorian calendar, can complicate record-keeping for certain industries, especially restaurants.

Due to its varying days each month (e.g., 30, 28, or 31 days), accounting periods will differ from year to year. This can throw off important financial reports like your balance sheet and profit and loss statement.

For example, if you want to compare holiday sales in 2023 with those in 2024, the dates won’t align properly.

The 13-Month Calendar, also known as the 13-period calendar, is the solution.

Unlike the 12-month calendar, the 13-Month Calendar consists of 13 accounting periods, each exactly 4 weeks (28 days).

This aligns with the weekly cycles used in many restaurants and hospitality businesses, providing more consistent comparisons on your profit and loss statement.

Each period has 28 days, creating an extra accounting period each year. Most importantly, every period contains an equal number of weekdays and weekends, making it easier to compare financials from period to period.

Additionally, the fiscal year always ends on the same day of the week, with Sunday or Monday being the most preferred dates for end-of-period activities like inventory counting and payroll processing.

It may sound a bit confusing at first, but we promise it’s not.

We’ve written a detailed blog post about the 13-month calendar and created a quick YouTube video for those who prefer watching.

We recommend familiarizing yourself with the 13-month period and ensuring your accountant uses it to provide accurate financial comparisons.

Does your restaurant accountant utilize the FICA Tip Credit?

The next important question to ask your restaurant accountant is which industry-specific tax deductions they are claiming on your behalf each year.

Most importantly: the FICA Tip Credit.

Unfortunately, we see this error often. Restaurant owners who use a local accountant or one recommended by a friend, but who lacks experience in the restaurant industry, can miss out on substantial tax savings.

For example, one of our new clients, who had been operating a bar generating around $500,000 annually for over five years, had never claimed this credit. Their previous accountant missed out on about $60,000 in tax credits!

While we were able to amend a few years of returns, more than half of the credit was permanently lost.

Don’t let this happen to you!

Along with other restaurant-related tax deductions, the FICA Tip Credit can save you thousands each year.

So, what is the FICA Tip Credit?

Essentially, the FICA Tip Credit is free money from the government that you can claim based on the tips reported by your employees.

We’ve written extensively about it here, and we’ve also created a handy calculator for you to estimate your potential savings.

The main takeaway is to ensure your accountant is taking advantage of this credit each year. If they’re not, they might not be the best fit for your business.

Which bookkeeping software does your restaurant accountant use?

Last but not least, what accounting and bookkeeping software does your accountant use for your restaurant(s)?

If it’s QuickBooks, it might be time to consider a switch. At the very least, have a candid conversation to understand why.

We’re quite passionate about why restaurants should avoid using QuickBooks for their finances, and we’ve written an entire series on it that you can check out here.

Here’s a summary:

When it comes to restaurant finances, Xero outperforms QuickBooks Online for several key reasons, including its intuitive interface, advanced bank reconciliation features, and unlimited user access.

But the main reason? Xero’s reporting functionality is unmatched.

This is crucial for restaurants for a few reasons:

As a restaurant owner, you need accounting software that can generate reports based on your specific 13-month calendar. (See point #1 above)

Your accounting software should also be able to run weekly reports.

With Xero, if your business week ends on a Tuesday, you can customize reports to run from Wednesday to Tuesday.

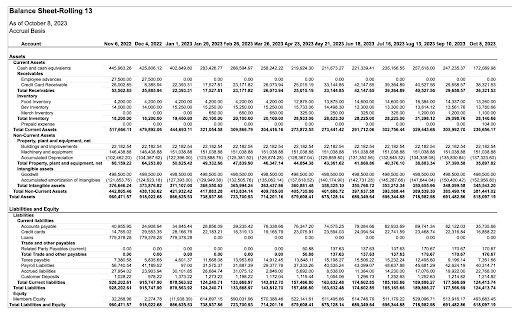

Here’s an example of a rolling 13-period report from Xero.

For those planning to sell their restaurant, Xero provides the annualized view of the business you’ll need to present:

Additionally, Xero offers the flexibility to organize your costs effectively. You can categorize expenses by prime costs (food and beverage, labor costs) and by controllable and uncontrollable costs.

Finally, Xero’s superior reporting allows you to run reports for multiple gross profit and ratio formulas.

For instance, you can generate simple reports to view food costs as a percentage of food sales or beverage costs as a percentage of beverage sales.

This is straightforward with Xero but can be challenging and costly with QuickBooks Online. In fact, if you can achieve it at all in QBO, it will cost significantly more.

With Xero, it’s just a flat $30 per month.

This benefit alone should be enough to convince you to switch to Xero!

If not, don’t worry. We cover more reasons to make the switch in this blog post here.

Looking for a better restaurant accountant?

If you’re on the hunt for a new restaurant accountant, or simply curious what another firm could offer, it’s important to not make the same mistake twice.

Not that we’re calling your existing accountant a mistake, per se, but we want you to be happier with your next decision.

We wrote a great blog post that outlines all of the things you should look for in a really good restaurant accountant that you can read here.

Wink, wink!

Alternatively, you can book a quick call with our team anytime, and we can discuss whether or not working with us would be a good fit for your business.

If it’s not? We’re not pushy. We’ll point you in the right direction to someone else who can help.

Ready to have a chat?

Simply use the calendar below to take the first step.

Until next time!

By MATT CIANCIARULO