How to Find the RIGHT Restaurant Accountant (Written By An Accountant!)

Are you tired of feeling like your restaurant accountant is just punching the clock and going through the motions?

It’s like they’re speaking in a different language, using tax jargon that makes your head spin.

But fear not, my fellow foodie entrepreneur!

As a restaurant accountant myself, I know that the accounting industry isn’t one-size-fits-all.

Every business has different needs, and your restaurant deserves an accountant who can meet those needs and then some.

Hey, you might even like tax jargon!

So, what should you look for when searching for the perfect restaurant accountant?

Here are some tips that will help you find a true financial partner in crime:

They Should Know the Restaurant Industry

First things first, you want an accountant who knows their stuff when it comes to restaurant accounting.

This feels like a given, right?

But more often than not, business owners start working with a local accountant who was referred by their peers and never take the time to seek out dedicated restaurant expertise.

Your business accountant should be well-versed in restaurant-related tax credits, and be able to help you save as much money as legally possible from Uncle Sam.

Believe it or not, there are many tax credits that restaurant owners may not even know about. So, finding an accountant who is on top of all the latest tax opportunities is a must!

They Should Do It All (Or Mostly!)

It’s not enough for your restaurant accountant to just handle your taxes. You want an accountant who can provide comprehensive services that meet all your financial needs.

Why? Because juggling multiple companies for bookkeeping, payroll, and financial advisory services can be a headache.

But when you find an accountant who provides all the accounting services you need under one roof, it’s like a weight has been lifted off your shoulders.

Not only does it save you time and energy, but it also helps your accountant keep a better eye on your expenses, cash flow, and tax credits.

By having access to all aspects of your business’s finances, your accountant can provide you with a better understanding of your overall business trajectory.

This means they can offer more insightful advice on how to improve your bottom line, make better financial decisions, and grow your restaurant.

They Use Modern Software & Apps

Now, let’s talk tech.

The best restaurant accountants stay up-to-date with the latest technologies available and can recommend and implement software and tools to help you automate time-consuming manual processes.

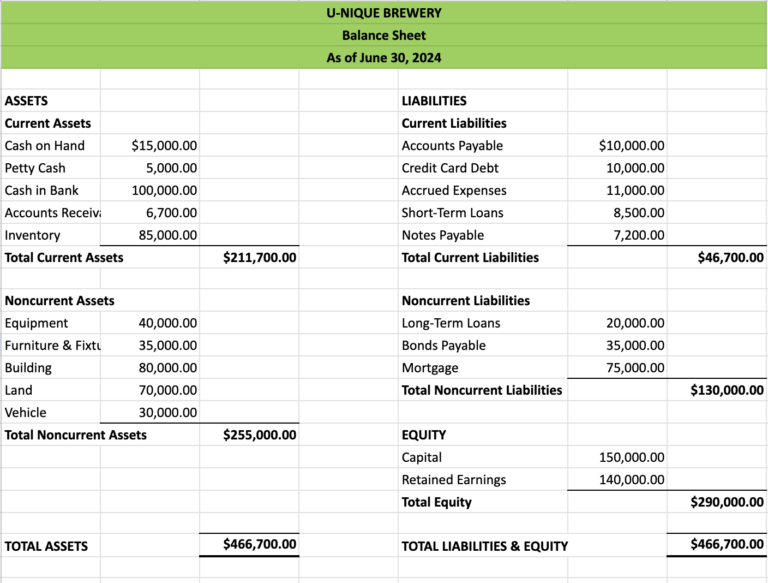

For example, at U-Nique Accounting, we’ve moved all of our restaurant & brewery clients over to MarginEdge for accounts payable because it can actually improve your business.

Unlike generic accounts payable and receipt scanning tools, MarginEdge gives you the ability to do recipe costing and inventory tracking, as it integrates with your POS system.

As you sell things throughout the week, MarginEdge will know what has sold and what raw ingredients have gone into the recipe. You can get recipe costing down to an exact science!

If you have an accountant who refuses to use industry best software, or worse, doesn’t know about it, then it’s likely your business as a whole will suffer.

They Talk To You Like You’re Human

Communication is key when it comes to the accountant-client relationship.

Even if you like the tax-jargon stuff, you want an accountant who is available to answer your questions and provide guidance on financial topics.

But it shouldn’t be a one-way street.

Your accountant should be proactive in teaching and educating you on your taxes and business.

It might sound funny, but we recommend working with a restaurant accountant who leans towards an “extrovert.”

I know, this basically eliminates most of the professionals out there, but in today’s world, THIS IS A MUST!

Finding an accountant who not only communicates with you but seeks you out as well is a must.

Your restaurant accountant should be proactive and willing to teach and educate you on your taxes and business.

They’re On Your Side

Last but not least, it’s important to look for a restaurant accountant who is on your side.

They want you to succeed.

They push you beyond your limits.

And they challenge you to think of business in a different way.

Your accountant should work as part of your leadership team. They are there to help you with complex financial decisions and should be your go-to resource for planning the next stages of growth.

Your restaurant accountant should be your #1 professional advisor that you receive and seek guidance from and should be an integral part of your leadership team.

So, if you get any inklings of being “just another number” in your introductory calls, it’s best to keep looking.

The right accountant for your business will “get you” and go beyond the standard practice to help you succeed.

Still Looking for the Right Restaurant Accountant?

If you aren’t happy with your current accountant, we’re always here to help.

You Can Take Our Quick 60-Second Quiz: Is It Time For a New Accountant?

Alternatively, you can book a 15-minute call with our team anytime, and we can discuss whether or not working with us would be a good fit for your business.

If it’s not? We’re not pushy. We’ll point you in the right direction to someone else who can help.

Ready to have a chat?