Our A-Z Brewery Bookkeeping Guide for 2023

Let’s face it.

Bookkeeping is one of those tasks that we all put off for as long as possible.

(Unless it’s your job like it is ours, of course).

And, we get it. Bookkeeping can be tedious, and mundane, and it takes a long time to do every month.

But it’s also super critical to the health and longevity of your business.

In fact, accurate and up-to-date books are non-negotiable if you want to stay in business long-term.

Aiming to sell your business in the future?

Want to grow 100% more than last year?

Simply want to know how much you’re netting each month?

You need to keep up with your bookkeeping.

In this blog, we’re going to cover everything you need to know about brewery bookkeeping. What tasks you should be doing every month, the best software to help, and things that you can learn from your bookkeeping each month.

Let’s start with the basics.

What is Brewery Bookkeeping?

Bookkeeping is like keeping a diary of all the money-related activities in your business.

It helps you keep track of the money coming in, the money going out, and everything you own or owe.

For a brewery, this means keeping an eye on the sales, inventory, the ingredients you use, and all the costs involved in making, distributing, and selling your beer.

It can be done in spreadsheets or ideally, in a bookkeeping software like Xero or QuickBooks Online.

What Tasks do you Need to Cover with Bookkeeping?

What makes bookkeeping such a “leave-it-for-later” task is the fact that so many variables are involved.

As part of your general bookkeeping, you’ll need to do the following tasks at the end of every month:

- Record your financial transactions: Jot down all the money stuff, like sales, purchases, and payments to your employees. Whether you keep this in a spreadsheet or in bookkeeping software, you’ll need to account for every financial transaction that happened within the business.

- Reconcile your bank statements: Check that your own money records match what your bank says. This can be quite tedious, but you’ll need to go line by line to ensure that the financial transactions you kept in step #1 match and cleared your bank statements. Both should “match” down to the penny.

- Manage accounts payable and receivable: You’ll also need to collect your sales invoices and pay your staff. Essentially, keep track of what you need to pay others and what others owe you.

- Manage your inventory: Inventory tracking is an important part of the bookkeeping process. Keep an eye on the ingredients, beer in production, and finished products to make sure you’ve got enough.

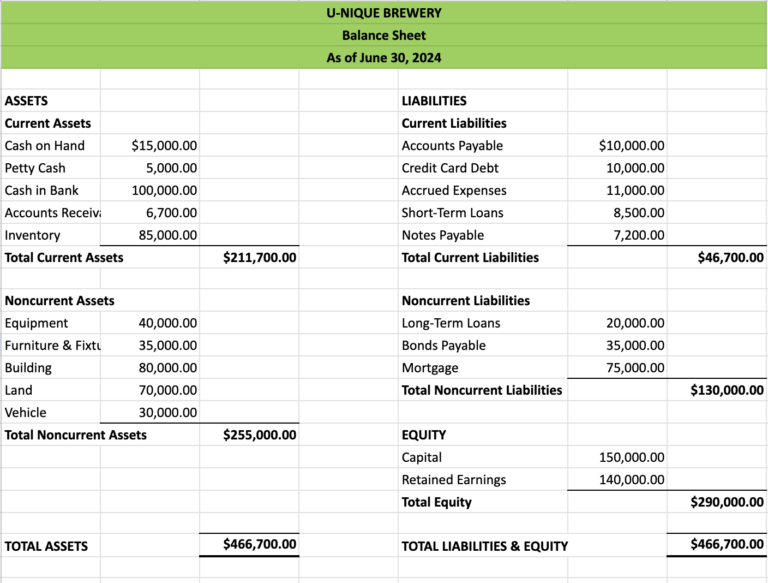

- Prepare financial reports: Finally, you’ll need to keep records of everything that happened and analyze the financial health of your business. You can create summaries of your brewery’s money situation, like your earnings, assets, and cash flow, using important financial statements like the Profit & Loss Statement (P&L).

How Often Should You Do Your Brewery Bookkeeping?

Bookkeeping should be an ongoing process, with financial transactions recorded daily or weekly.

However, we imagine that most people wait until the end of the month to do their bookkeeping… and that’s okay. You have to do what works for you.

However, if you find yourself letting months go by without reconciling your bookkeeping, it’s time to get the help of a professional.

Monthly reconciliations and reports are essential to maintain an accurate understanding of your brewery’s financial health.

What Can Bookkeeping Tell You About Your Business?

The best thing about bookkeeping is that when it’s done properly, you’ll actually look forward to doing it every month (or having it done for you).

Why?

Because proper bookkeeping can tell you really neat things about your business, and provide valuable insights into your brewery’s financial performance.

Here are a few things that ongoing bookkeeping can tell you:

- Profitability: This is why you’re running a business, right? Your books will tell you just how profitable your business is (i.e. how much you’re keeping each month). We recommend tracking and analyzing your brewery and taproom profitability separately to identify the most profitable aspects of your business. And, remember, profitability is not the same as cash flow.

- Cash flow: This is another big one. It’s impossible to run a successful business without a healthy cash flow. Through ongoing bookkeeping, you’ll be able to find financial “habits”, such as how much you’re spending in different areas each month and how much cash is coming in and out, and where it is coming from. With accurate books, you’ll be able to forecast your cash flow for the months ahead, make sure you can meet your financial obligations, and plan for future investments.

- Inventory management: Identify trends in raw materials usage, production, and sales to maintain adequate inventory levels. You can also track your R&D costs incurred during production.

- Cost control: Identify areas where you can reduce expenses and improve efficiency in your operations.

Which Bookkeeping Software is Best for Breweries?

If you’re regular readers of U-Nique Accounting, you’ll know that we strongly recommend Xero for your bookkeeping software.

That’s right, it’s past time to ditch your QuickBooks Online.

There are a lot of reasons for this, which you can read about here, but the most important reason is customized reporting.

QuickBooks has canned reports, sure. But Xero lets you create custom reports tailored to your brewery’s needs.

Here’s the example we like to use:

Think about a custom home builder vs. a large home builder.

With a custom home builder, you get to work with the architect, designer, and builder to design the home exactly how you want it.

With a large home builder, you’re going to get more of a cookie-cutter home.

In this example, QuickBooks Online is the large home builder and Xero is the custom home builder.

And this is a big deal for breweries.

As a brewery owner, you need accounting software that can run reports based on your specific 13-month calendar. (Learn more about the 13-month calendar here.)

Your accounting software needs to have the capability to run weekly reports.

With Xero, if your business week finishes on a Tuesday, you can customize the reports to run from Wednesday to Tuesday.

Additionally, with Xero, you have the flexibility to organize your costs in the right way. You can easily organize your costs by prime costs (food and beverage, labor costs), and also by controllable and uncontrollable costs.

Finally, with Xero’s superior reporting, you can run reports for multiple gross profits and ratio formulas.

For example, when looking at food costs, you can run simple reports to see food costs as a percentage of food sales. Or, beverage costs as a percentage of beverage sales.

This is super simple to do with Xero, and not so much with QBO. In fact, if you are even able to do it at all in QBO, it will cost you a lot of money.

Whereas with Xero, it only costs you a flat $30 / month.

This reason alone should be enough to convince you to make the switch to Xero as a brewery owner!

What Bookkeeping Tips Can You Tell Us (From an Accountant)?

We wrote an entire blog post about our bookkeeping tips for breweries, which you can read here.

But if you’re out of time, you can read the cliff notes here:

- Use the right tech stack: Xero accounting for bookkeeping, MarginEdge for accounts receivable, and Gusto for payroll are our top recommendations for brewery bookkeeping.

- Use a POS that integrates with your other solutions: While we don’t have a specific POS that we recommend, we do want it to integrate seamlessly with your other software. This ensures seamless data flow between your sales, inventory, and accounting systems.

- Create Raw/WIP/FG inventory categories: This helps you keep track of your inventory levels and production processes.

- Track Brewery and Taproom Profitability, Separately: Analyze the profitability of each aspect of your business to make informed decisions.

- Use a Brewery Management Software (When Ready!): Ekos or Beer30 are great solutions to help manage your inventory, track sales, and provide valuable business insights.

Need Help With Your Brewery Bookkeeping?

We hope we’ve covered everything there is to know about brewery bookkeeping!

However, there is a lot more to stay on top of when it comes to keeping healthy books.

For example, monitoring your cash flow, forecasting for various scenarios, and identifying opportunities to increase margins are all equally important tasks when it comes to running and growing a prosperous brewery.

If you need extra help digging in to learn about the numbers in your business, you can reach out to us anytime for help.

It’s what we’re here for.

Simply use our form here to get started.

Until next time!