Best Cash Flow Forecasting Software in 2023

Having a good cash flow forecasting software can make or break your business.

Cash flow forecasting software can be a driving force behind business success.

It dives deep into your numbers to give you a real-time view of your cash flow so you can make more confident decisions about your business.

However, cash flow forecasting software won’t be helpful without a strong understanding of what cash flow is and what it means for your business.

And considering 82% of businesses fail because of cash flow problems, there is clearly a disconnect. This article will help you grasp the importance of cash flow and give you an explanation of Float, the cash flow software tool we use and recommend at U-nique Accounting.

What is Cash Flow?

Cash flow is the measure of cash moving in and out of your business. A strong cash flow, which is ideal, means you have more money coming in than going out.

This allows you to:

- Easily pay your expenses

- Get insight into your liquidity

- Measure your profitability

- Invest money for additional income streams

Not only does cash flow management help for running your business in the short term, but you can use cash flow forecasting to help with long-term decision making.

Why is Cash Flow Forecasting Important?

Cash flow forecasting is essentially an estimate of the amount of cash you expect to be flowing in and out of your business.

Oftentimes, business owners will project profit, but not cash flow. However, this does not provide an accurate picture. There are many instances where a business can have positive profits, but negative cash flow.

Forecasting gives you the future-focused eyes you need to ensure you’re always seeing a positive cash flow.

When you use cash flow forecasting, you can also:

- Easily spot potential problems before they arise

- Prepare for smaller cash inflows or larger outflows and mitigate the impact of cash shortages

- Predict how much more cash inflows you’ll need to reach your growth goals

While cash flow forecasting can be done manually, there are cash flow software tools you can use to give you real-time, accurate numbers for easier management.

The Best Cash Flow Forecasting Software: Float

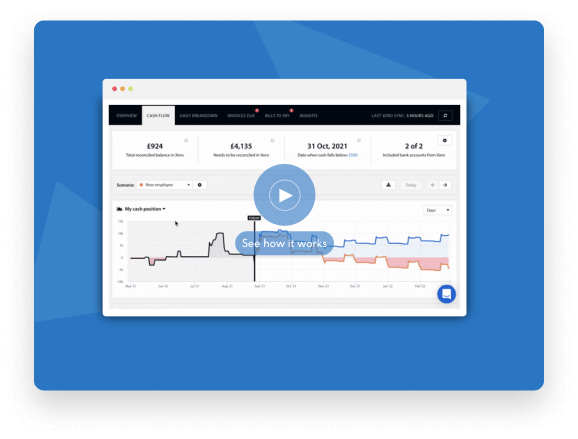

At U-nique Accounting, we use and recommend Float. Float is a cash flow forecasting and scenario planning tool that gives you a real-time, visual view of your cash flow.

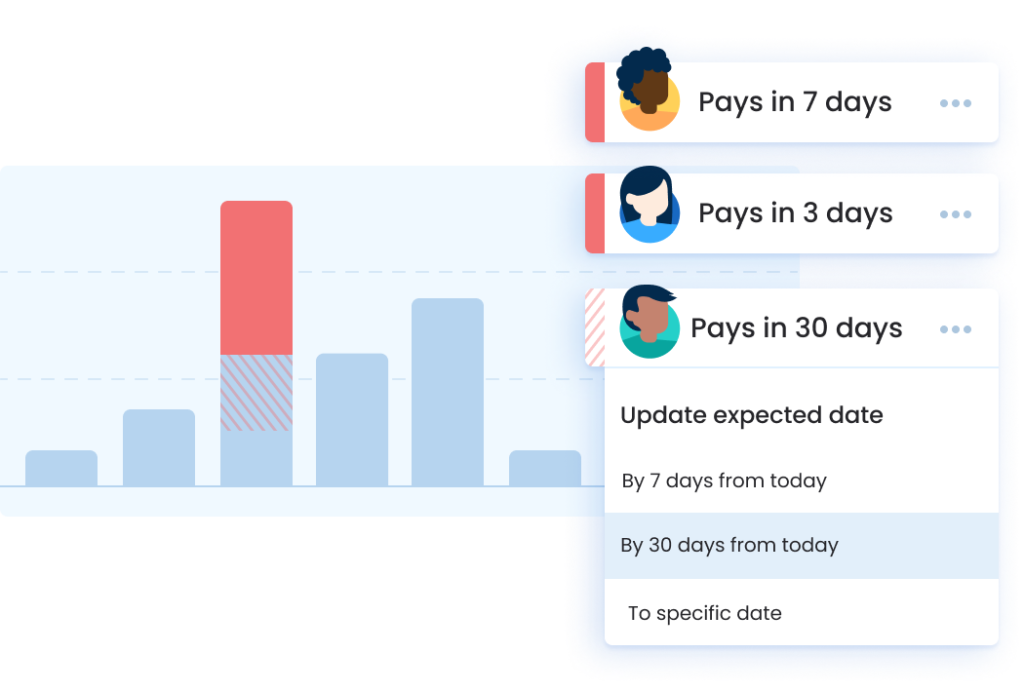

Along with budget creation and comparing your actuals against those budgets, the scenario planning feature of Float is second to none. You can easily model different hypothetical cash situations to see how they compare to your actual forecast.

Float also lets you layer different scenarios to see how they compare. Potential scenarios include:

- Sales increases

- Unexpected costs

- Hiring new staff

- Seasonal planning

One of the best Float features is the ability to look at cash projections for any time frame, whether it be next week, month, or year.

With Float’s cash flow forecasting software, you can forecast your cash with accuracy and make business decisions with confidence.

Reach Out to U-nique Accounting for Help Managing Cash Flow

Even with the help of tools like Float, you can still get stuck when it comes to cash flow. This is where we suggest calling on an accountant for guidance.

At U-nique Accounting, one of our top priorities is cash flow management. We use Float to help us put together projections, compare them against your actuals, and get real-time numbers.

Then we use that information as a guide for determining what steps to take next.

We’ll implement strategies to improve your cash flow and monitor it consistently so you always have an idea of where your business stands.

To learn more about how U-nique Accounting can help you manage your cash flow, contact us today!