Do We Recommend MarginEdge for Restaurants?

In case you didn’t know, MarginEdge is a popular restaurant management software that uses POS integration and invoice data to show you your food and labor costs in real-time. This allows you to make informed decisions in the moment, rather than weeks after the period ends.

At least that’s what it says on their website.

But how useful is MarginEdge really?

Is the software accountant-approved?

As experienced restaurant accountants, we feel qualified to jump in and give our opinions here, so let’s dive into our review of MarginEdge for restaurants.

Here’s what we think.

What Is MarginEdge Used For?

As mentioned, MarginEdge is a restaurant management software that’s used for managing and simplifying the operations in your restaurant.

It overhauls things like invoice processing, food cost management, inventory tracking, and more, aiming to simplify the tracking and analysis of your restaurant in real time.

The idea is that with the data you get from MarginEdge, the more smoothly and profitably you’ll be able to run your business.

But does it live up to its hype?

Let’s take a look at its features in more detail.

MarginEdge: Invoice Processing

In the restaurant business, time is money. This is why as accountants, we really like this MarginEdge feature.

While invoice processing can often be time-consuming and prone to errors, MarginEdge can do the job for you in half the time.

Once invoices are sent via the mobile app, email, or directly from vendors, MarginEdge automatically handles them, extracting line item details within 24-48 hours.

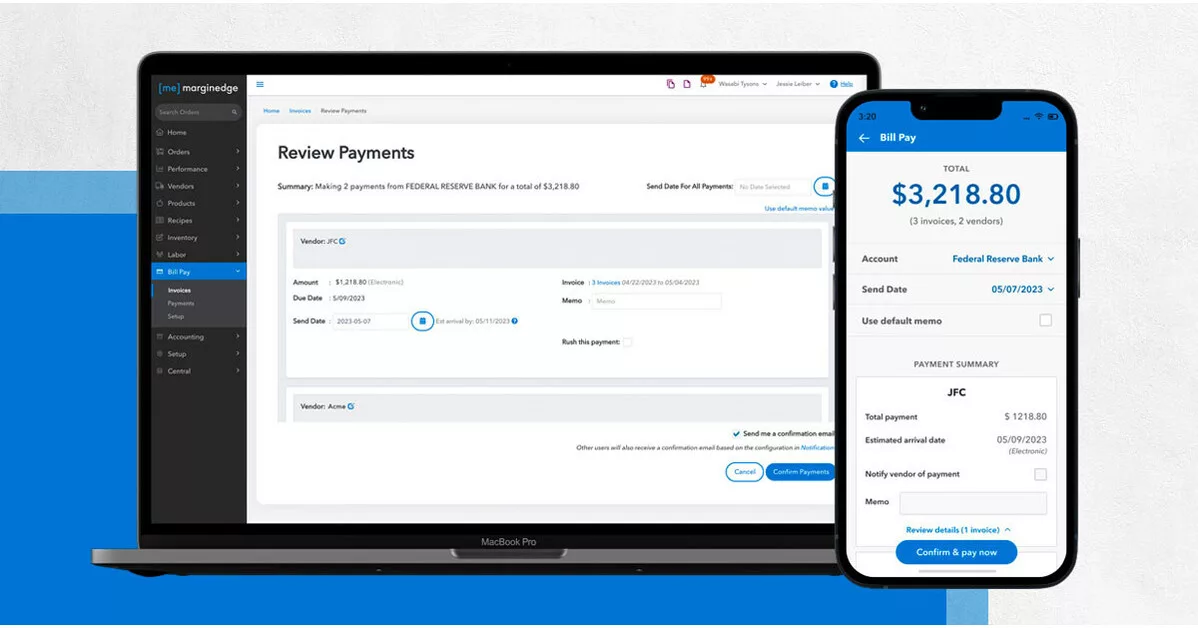

You don’t need your managers sitting in the back office for hours entering in invoices. With MarginEdge, you can simply snap a picture, send it for approval, and even pay the bill directly in MarginEdge.

That’s right.. you can pay invoices directly in MarginEdge itself with just a few clicks!

MarginEdge actually does all of the work of cutting the check and sending it to the supplier, or sending an ACH or credit card payment too. All of the work that you usually do in-house can be done by the system.

After that, it can be directly synced to Xero (our fav!), as well as some other accounting platforms.

The amount of time this feature saves you really is unbelievable.

Additionally, this speedy and accurate invoice processing gives MarginEdge the ability to offer other really cool features, such as real-time inventory management & recipe analysis, which we’ll get into next.

MarginEdge: Cost Analysis & Management

When it comes to features, the invoice processing functionality “walked” so that the cost management feature can “run”.

In short, the invoice processing lays the groundwork for the cost management feature to really shine.

You don’t need to be an accountant to know that effective cost management is crucial for your bottom line.

What MarginEdge can do is provide real-time data on your food and labor costs as they occur.

It can show you practically every aspect of your restaurant’s costs in one place including daily P&Ls, price changes in your most-used products, and even food usage and waste.

It even updates your reports as invoices come in so there are no surprises when the period ends.

With these live daily Profit & Loss statements, your operations manager can immediately monitor sales, costs of goods sold, and labor expenses. So, no more guessing or waiting until the end of the period to identify higher-than-normal costs!

As accountants, this feature is key because it enables you to proactively change your budget and keep track of costs, either as a percentage or in dollars, so that you can control your finances in real-time.

MarginEdge: Inventory & Food Usage

Inventory management is often dreaded in the restaurant business, but MarginEdge’s inventory tool can save you hours of manual data entry each week.

Here are a few ways that it simplifies counts for you, either digitally or on paper.

- Since the tool is connected to your invoice data, it automatically updates the prices of the items in your inventory. This means that the costs are always current, without you having to manually adjust them.

- The tool allows you to monitor your stock levels in real-time. You’re able to quickly see what’s in stock, what’s running low, and what needs to be ordered.

- It integrates with the recipe management tool. When you adjust recipes, the inventory tool takes note and helps you understand how these changes will affect your stock levels and costs. Cool, right!

It also helps you watch your stock levels closely, making it easier to spot waste or theft. This helps you use your food more wisely and reduces losses.

MarginEdge: Recipe & Menu Tool

The MarginEdge recipe tool is also a real game changer.

You can manage recipes from one central cloud-based system, so if you run multiple locations, you can make adjustments to recipes in one place, and the team will immediately have access to it.

The best part is that prices are always updated automatically, so if the cost of salmon goes up or if you sub something out, you can see an updated plate cost instantly.

This allows you to control your margins in real-time.

Our Favorite Things About MarginEdge for Restaurants

If it isn’t already clear, the verdict is in: we love MarginEdge for restaurants.

And no, we aren’t sponsored to say that! In fact, we don’t have any affiliation with the software whatsoever.

We just really like it, and encourage all of our clients to use it.

One reason we like it so much is that it was built by people in the restaurant industry, meaning it directly addresses many pain points of restaurant owners.

You can read more about how it all got started here.

Another reason is that it integrates seamlessly with Xero.

Xero is the bookkeeping software you must be using if you’re running a restaurant or brewery. Hint: QuickBooks can’t work for you!

Data flows smoothly between the two cloud-based systems.

MarginEdge sends invoices and journal entries (sales data, inventory adjustments, and non-AP expenses) to Xero.

Invoices, sent as bills, show up in Accounts Payable (AP), and these bills can be paid in Xero.

Together, financial reporting doesn’t get any more accurate or simple.

If you have questions about how MarginEdge can work in your restaurant, or how it can work with Xero, feel free to reach out to us anytime.

We’re always here to help.

Simply book a chat on our calendar below.

In the meantime, we recommend checking out our series, ‘Xero vs. QuickBooks‘—it’s one of our most popular!

Until next time!