What the 2025 Tax Bill Means for Restaurants and Breweries

If you own a restaurant or brewery, you’ve probably heard about the new tax bill for restaurants and breweries passed in July. Officially called the 2025 Tax Relief Act, it spans 900 pages but we’ll focus on the sections that really matter for food and beverage business owners.

In short: there’s a new personal tax deduction for tips and overtime, but there’s also more reason than ever to clean up how you handle tips in your payroll system because most restaurants still get this wrong.

Let’s break down what the new tax bill for restaurants and breweries mean.

The New No Tax on Tips Rule (for Employees)

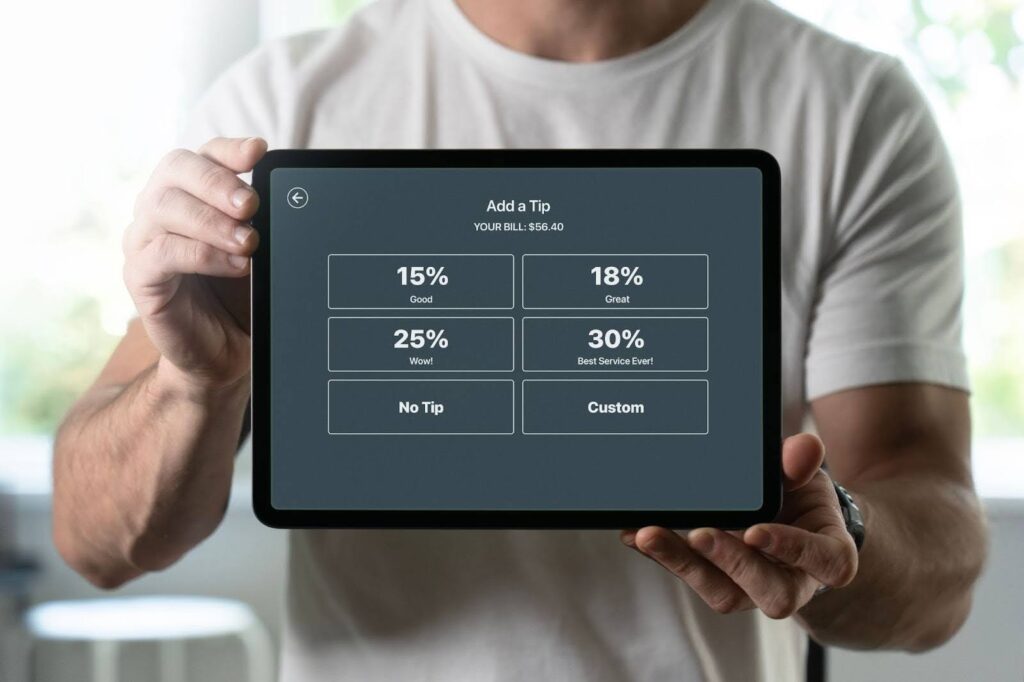

This is one of the headline changes: from 2025 to 2028, employees who receive tips can deduct up to $25,000 of that tip income from their taxable income. No need to itemize.

That means lower federal income tax bills for tipped employees like servers and bartenders.

But only VOLUNTARY tips count.

That means any automatic gratuity, service charge, or catering fee won’t qualify for the deduction.

Here’s why it matters for you as a business owner:

- Tips must be entered as tips, not wages, to be eligible.

- Automatic gratuities ARE NOT considered tips, and should be reported as wages, and are thus not eligible to be tax exempt under the new rules

- To qualify as a tip, the amount has to be determined and given willingly by the customer. When a business collects these amounts, they are in essence a loan from the customer that you HAVE to pay out to the employees. It is not revenue and is not a deductible expense.

- Autogratuities are a pre-determined amount that is charged to the customer, and even though you will most likely pay these amounts out to your employees (not required to), they are considered a “charge” to the customer (revenue) and then when paid out they are supposed to be reported as wages (a deductible expense).

- Employees still get the money either way, but how you classify it matters to the IRS and to your staff.

Bottom line: This is not new and has always been the proper way to report tips & auto gratuities. If your POS is working properly, it should already tell you what’s a tip vs. a gratuity.

But if you’re still lumping them together or using an integrated payroll service that doesn’t handle this properly, now’s the time to fix it.

P.S. – don’t assume this is being done correctly because many of the POS Programs (like Toast and Square) that also provide payroll services DO NOT handle this correctly for you. You need to oversee and review the data to make sure it gets reported correctly.

The FICA Tip Credit Still Matters (for You)

Under the new tax bill for restaurants and breweries, the new tip deduction applies to employees, but you can still claim the FICA Tip Credit as a business owner. This credit covers the employer share of Social Security and Medicare taxes on reported tips.

That means:

- The more tips are reported correctly, the more you save in payroll taxes.

- If your system misclassifies auto-gratuity as tips, you are claiming a higher credit than you should be

- If your system treats tips as wages, you’re leaving money on the table.

With the new tax bill for restaurants and breweries we’ve seen restaurants with strong systems still miss tens of thousands in tax credits due to incorrect payroll mapping.

Clean classification equals real tax savings.

Pssst… if you haven’t already, try our free FICA Tip Credit Calculator HERE to calculate your savings.

Other Business-Friendly Changes in the 2025 Tax Relief Act

While the tip stuff is important, there are other wins in this bill worth knowing about:

100 Percent Bonus Depreciation Is Back

Thanks to the new tax bill for restaurants and breweries, you can once again fully deduct the cost of qualified purchases like equipment, furniture, or renovations in the year you make them.

This is huge if you’re planning to update your kitchen, open a new location, or renovate your space. A $100,000 upgrade could translate to a $25,000 tax savings.

Section 179 Expensing Limit Raised

You can now expense up to $2.5 million in qualifying equipment, with phaseouts starting at $4 million.

Section 179 is especially helpful for used equipment and doesn’t require you to be profitable to take the deduction, unlike bonus depreciation.

R&D Expenses Can Be Deducted Again

Under the new tax bill for restaurants and breweries, you no longer have to amortize domestic research and development costs over five years. If you’re testing new menu concepts, brewing processes, kitchen automation, or other innovations, these expenses may now be fully deductible in the year they occur.

Even if you don’t think of your business as a tech company, R&D tax credits might apply more than you think. We’ve claimed them for breweries developing new recipes and restaurants piloting new ordering systems.

QBI Deduction Made Permanent

The new tax bill for restaurants and breweries locks in the 20% deduction for pass-through income from S Corps, partnerships, and sole proprietors. Phaseouts and income limits still apply, so choosing the right entity remains important. Additionally, leveraging the best AI tools for restaurants in 2025 can help owners optimize operations, track finances, and ensure they’re maximizing tax benefits efficiently.

Individual-Level Changes That May Still Apply

Because many restaurant and brewery owners take income as pass-throughs, some of the individual tax updates also matter:

- Lower Tax Brackets Made Permanent: The TCJA-era tax brackets are locked in, meaning you keep more of your pass-through income.

- Expanded Child Tax Credit: Up to $2,200 per child, with inflation adjustments.

- Higher Standard Deduction: $31,500 for married couples in 2025.

- New Senior Deduction: $6,000 for those over age 65 and under certain income levels.

- SALT Deduction Cap Temporarily Expanded: Up to $40,000 in 2025 for state and local taxes, before phasing back down.

So, What Should You Do Now?

If you own or manage a restaurant, brewery, or bar, now’s the time to:

- Review your POS and payroll setup

- Make sure tips and gratuities are classified correctly

- Check if you’re already taking advantage of the FICA Tip Credit

- Plan ahead for any equipment or renovation purchases

- Talk to your accountant about R&D opportunities

At U-Nique Accounting, we live for this kind of stuff, the real-world details that actually affect your tax bill.

Book a time to talk with our team, and we’ll help you put these new rules to work in your favor.

Simply use the calendar below to schedule a quick call.

Until next time!

By MATT CIANCIARULO