Our Tips For Restaurant Cash Flow During Tough Times

The past years haven’t been easy for anyone, especially in the restaurant business. With inflation, higher supplier costs, and pricier ingredients, the challenges in the hospitality industry continue to grow.

As a business owner, your restaurant must make strategic financial moves during tough economic times to thrive. Since you’re not an accountant (that’s our job!), we thought we’d offer a few recommendations and financial tools to help your restaurant’s cash flow run more smoothly.

Below are our six tips to help you increase your cash flow during difficult times:

Restaurant Cash Flow Tip #1: Go Through Expenses & Cut

Cutting back on expenses is a sure way to increase your cash flow. To start, consider reducing the following costs:

- Food & Beverage: Analyze your food and beverage costs to see if you are missing out on buying in bulk, having too much waste, and have increasingly paid higher prices without a corresponding markup in your menu pricing.

- Consider purchasing these items through a restaurant buying group to save money.

- Use tools like MarginEdge to track inventory precisely and avoid ordering unnecessary items and to get insights into food waste.

- Non-Core Staff: For non-core functions, consider hiring contractors instead of employees to save on taxes and insurance-related fees.

- Advertising: Review your advertising spend to see if there are areas/campaigns that produce minimal results.

- Lighting: Switch to energy-efficient lighting, such as ENERGY STAR-certified bulbs, to reduce electricity costs.

Restaurant Cash Flow Tip #: 2 Increase Your Prices

Consider raising your menu prices to increase profit margins.

Raising food prices may seem scary at first, but there’s a good chance that it’s long overdue in your restaurant.

I mean, have you seen what your competitors are charging?We wrote a really great blog post all about restaurant pricing here.

Restaurant Cash Flow Tip #3 Adjust Your Menu Items

Do you have a large menu? If you have watched any food show on bar/restaurant operations they always push smaller menus. It helps keep your kitchen efficient and saves you money.

Review your sales data to identify popular and underperforming menu items. Removing items that are rarely ordered can help cut long-term costs.

Replace or substitute expensive menu items. Can you replace a menu item completely with a new entree that uses cheaper ingredients but does not lose out on flavor? What if you simply substituted in some cheaper ingredients that still kept the dish tasting great, but increased your margin on that entree 5% every time it is ordered?

Review your portion sizes and make cuts. If food is routinely being thrown out or handed to customers in take out boxes, then your portion sizes are probably too big. Less is more. Cut back on portion sizes, but deliver a better bite.

Restaurant Cash Flow Tip 4#: Create a Reliable Forecast

It may sound cliché, but forecasting is an essential tool for managing cash flow in a restaurant. Here are some tips for creating a reliable forecast:

- Understand your sales: Analyze your sales history and understand how your revenue fluctuates. Identify seasonal trends, such as busy and slow periods, and try to forecast how these trends will continue.

- Track expenses: Closely track your expenses, such as food costs, labor, inventory, rent, utilities, and other overhead expenses.

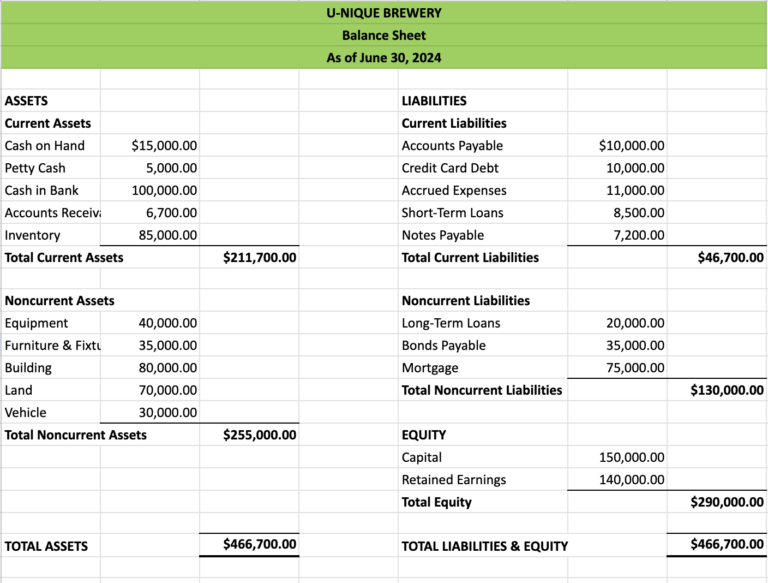

- Use financial data: Use your financial data to identify gaps in your cash flow. Tools such as profit and loss statements, balance sheets, and cash flow statements can help you understand your financial position.

- Use technology: Use restaurant management or accounting software to streamline your reporting and forecasting. These tools can provide insights and analytics to help you forecast cash flow accurately.

- Evaluate trends: Stay up-to-date with industry trends, such as changes in consumer preferences or the impact of external factors such as pandemics or natural disasters. Incorporate these trends into your forecasting to account for any potential risks.

- Assess your borrowing needs: Forecasting can also help you determine your restaurant’s financing needs and provide insights into potential repayment schedules.

Restaurant Cash Flow Tip #5: Create a Budget and Stick To It

Stick to your budget even when something unexpected arises, or a tempting purchase comes. Here is a general guide to creating and sticking to a budget:

- Calculate your income: Determine your restaurant’s required monthly net income and make that your starting point. We wrote more about this “bottom-up” approach here.

- Categorize your expenses: Divide your monthly expenses into fixed and variable categories. Fixed costs, such as rent, mortgage payments, and subscription services, remain the same each month. Variable prices fluctuate monthly, like groceries, travel, and other discretionary spending.

- Prioritize spending: Determine your most essential expenses, such as loan payments, rent, and utilities, and ensure you allocate enough funds for them in your budget.

- Track expenses: Once you establish your budget, track your expenses daily, preferably through Xero accounting software. This helps you see where your money goes and whether you are sticking to your financial goals.

- Review your budget regularly: Review your weekly or monthly budget with an experienced accountant to ensure you’re financially on the right track.

Take a look at the Relay Financial and the Profit First method if you need help budgeting your cash flow.

Restaurant Cash Flow Tip #6: Do Not Ignore Customer Feedback

Pay attention to customer feedback and reviews regarding specific dishes. If you find a particular menu item or area of your establishment, that customers are routinely dissatisfied with, save money by making the appropriate changes.

Do you see the same specific plates of food routinely showing up in your kitchen to be mostly thrown out? That is non-verbal customer feedback telling you that it needs to be replaced or have a makover.

Need More Help With Your Restaurant Cash Flow?

At U-Nique Accounting, we’ve been in the restaurant, bar, and brewery industry for quite some time now, and we know what it takes to run a successful business.

If you have questions about your restaurant’s cash flow that we didn’t answer, you can get in touch with us anytime. We’re always happy to help.

You can book a complimentary call down below or reach out to us via our Getting Started page.

Until next time, stay u-nique!