Xero vs QBO: Bank Reconciliations

Stop using your parent’s accounting software and join the Xero revolution.

Check out our previous Xero vs. QuickBooks Part I Blog if you haven’t already.

Whether you are a current QuickBooks user looking to make a switch, or are just starting your business and trying to determine which software is right for you, we are here to help.

Most of you have used or heard of the accounting software QuickBooks (QBO).

In America, QuickBooks (QBO) has become synonymous with small business accounting as it has been around for a very long time.

However, since QuickBooks (QBO) was first introduced, technology has continued to improve, and something called the Internet came and introduced us to an entirely different way of working.

In essence, the technology that QuickBooks was built on no longer works for the modern business owner.

Here are 5 main reasons, after 15 years in the industry, that we made the switch from QuickBooks to Xero.

- Xero is cloud-friendly

- Xero has a killer bank recording/reconciliation feature

- Xero allows you to create your own customized reporting

- Xero is designed with you, the business owner in mind

- Xero has unlimited users

In today’s blog, we’re going to dive deeper into reason two – bank recording and reconciliation features.

Want to watch instead of read?

Xero vs. QuickBooks: Bank reconciliations

The #1 accounting activity that a business owner has to worry about, regardless of industry or company size, is recording and reconciling their bank and credit card transactions.

This is where Xero really shines as their process is simply amazing and effortless.

Folks, it’s not even close here.

This is the killer feature of Xero that completely and utterly destroys QBO.

Xero’s bank feed process makes it really easy to either match or record missing transactions, and it ensures that all transactions are accounted for, no ifs ands or buts!

Artificial Intelligence

First, let’s talk about the artificial intelligence aspect of the software.

Let’s pretend that you do not record any vendor bills (whether manually or via an automation software like Dext) and you do not record any vendor payments.

Well, if you are using Xero, you are in luck.

Their AI is superior in assisting you with recording all your bank and credit card transactions.

The AI will suggest what type of transaction to record, which vendor to record the transaction to, and suggest which general ledger account to record the payment to.

The more and more you use the software and record transactions, the better its suggestions will become as it learns how you code the payments.

QBO has a good AI, but its general ledger account suggestions are not as consistently great as we see in Xero.

Also, the type of transaction their AI recommends to record is generally a bit off.

Here are the typical choices:

Deposit, payment, and transfer.

Deposits are for money received, payments are for money spent, and transfers would be for amounts moved between bank accounts.

For some reason, QuickBooks’s AI will often suggest “transfer” as the transaction type instead of “payment”.

The reason behind this is beyond me, but it is what the software does.

A transfer is a movement of funds between two bank accounts, not a payment of a utility bill.

Recording/Matching Bank and Credit Card Transactions

Formatting

Let’s talk about the format of the bank feeds – it’s again where Xero shines.

Xero lays out their process in a vertical format with two columns:

- 1 column for the amount per your bank account, and

- 1 column for recording/matching the transaction in your general ledger.

Each row represents a transaction and they provide spacing between each row to clearly separate the lines so you can read the information easier.

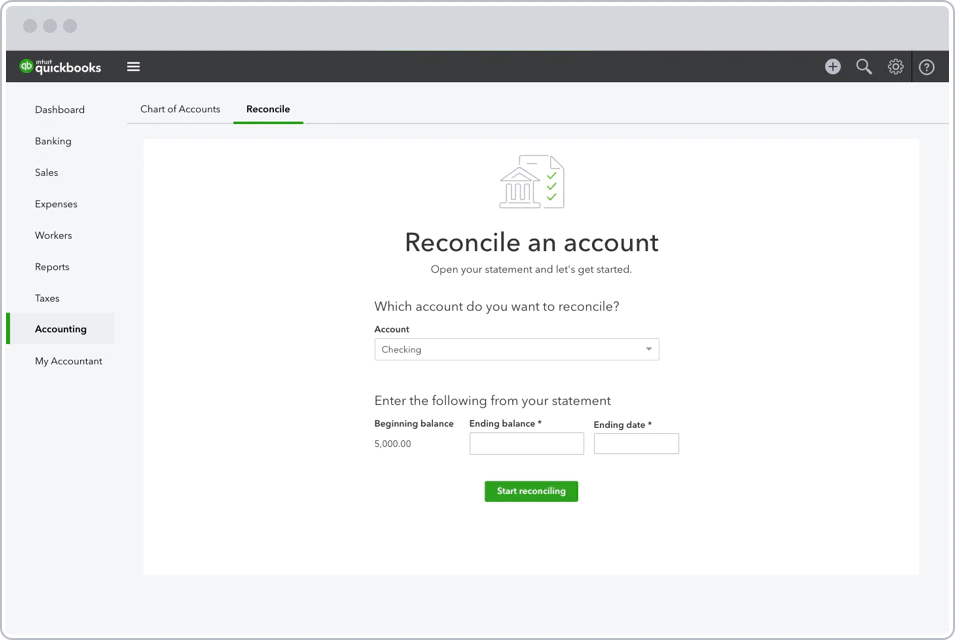

QuickBooks lays out its process in a more clumsy horizontal format that has columns for the date, description, payee, category or match, spent, received, and action.

All the rows are very condensed and have no spacing between them, making it harder to read each transaction that you are trying to record/match.

Coloring scheme

Xero has a really simple color coding scheme that uses 3 colors: green, blue or black/white.

- Green is designated for matches to existing transactions. If the bank transaction matches a bill/payment already recorded in your general ledger, Xero will highlight the entire transaction in the right column completely green and give you a big blue button in the middle that says “Ok”.

- Blue is designed for matches to existing banking rules. If the bank transaction matches a banking rule, Xero will add a blue bar to the edge of the box in the right column and will show you the name of the bank rule in blue text.

- Black/White are used when the bank transaction has no match. Xero leaves the right column in a normal white/black format, regardless if the AI has a suggestion or not.

QuickBooks has a complicated coloring scheme that uses a variety of greens.

- Green Box: If the bank transaction matches a bill/payment already recorded in your general ledger, then it will have a small green box in the category/match column that says ‘match found’.

- Green Box and Green Text: If the bank transaction matches a bank rule that you have set up, there will be a green box that says “Rule” and the text color of the general ledger account will be green.

- Green Text: If QBO has a strong suggestion then it will highlight the text color of the general ledger account in green

- Black/White: If QBO has a weak or no suggestion, then the format is a normal white/black.

Suggestions, regardless of how good they are, should stay black and white, as green has a certain connotation to it.

When you see green you immediately think “good” like it matches something and will click to add it.

Applying names to transactions

I can’t believe this is even an issue, but let’s talk about it.

When looking back at transactions in your general ledger, one of the best “tags” that a transaction can have is the name attached to it.

This way you can see what you are spending and who you are spending it on.

Xero

Xero requires a name for all transactions, period.

You cannot record a bank feed transaction without applying a name to it.

This is a great software parameter setting as every dollar recorded to your general ledger has to have a name associated with it.

This way you can see it when reviewing your general ledger details and when you look at a vendor/supplier report you hopefully see all transactions related to them.

QuickBooks

QuickBooks fails in this process as they do not require a name to record incoming bank feed transactions.

This alone is a big issue in itself, but there is one other issue that is to blame for the process of the name being left blank.

QuickBooks is deceiving when it comes to assigning a name as they make it look like it has already been done.

We believe their horizontal format is the reason why it is deceiving.

QBO has a column for “description” which will usually reflect the name as seen in the details of the bank feed.

This makes it appear as if QBO has identified and tagged a name to the transaction, but this is false.

QBO will record the transaction and if the payee’s name was blank, it will leave the payee name blank.

When you run a general ledger report you will see that many of your transactions have no name assigned, as the name is buried in the memo/description, which means you can’t run accurate vendor reports, sort reports by vendor, etc.

Bank Reconciliation Process

The best feature of utilizing bank feeds and recording/matching them to your general ledger is that you are completing your bank reconciliation at the same time.

(Yes, this is all completed in one step).

While this holds true for Xero, it is not true for QBO.

Xero

In Xero, you match/record transactions and perform the bank reconciliation at the same time – one process. Once a bank transaction is matched, it becomes “locked” as a reconciled transaction.

The only way to unreconcile it is to void (remove and redo) which deletes the transaction and puts it back into your bank feed screen to re-record.

Once you are done matching the bank or credit card transactions for a given period, you can run a reconciliation report which will show you any unreconciled general ledger transactions that have been recorded for which no matching bank feed has been found.

QuickBooks

The QuickBooks process is not as effortless and leaves room for error.

Recording transactions and performing the bank reconciliation are two separate processes.

When a bank transaction is matched, it will show up with a checkmark on the bank reconciliation screen, but it won’t be “locked”.

This means that when you go to perform your bank reconciliation, you can actually uncheck the bank feed transaction to make it an unreconciled transaction, and check off unreconciled transactions from your general ledger as reconciled transactions – even though they had no corresponding bank feed match.

To reiterate: In the reconciliation screen, you can take a bank feed transaction that actually happened and uncheck it to make it an unreconciled transaction.

Why? We don’t know. But it doesn’t make sense and it opens the door for errors to be made.

Also, in the bank reconciliation module, sometimes QBO will automatically mark a general ledger transaction as reconciled, even though it didn’t match any of the bank feeds.

This will make your bank reconciliation have an unreconciled variance, which gives you more work as you now have to re-reconcile.

Again, just weird.

By separating the bank feed and bank reconciliation process, QuickBooks took the best part of a simple process and made it unnecessarily complicated and prone to error.

Difficulty determining if a transaction has been reconciled or not

A small issue, but one nonetheless.

Xero

If you are browsing in Xero and click on a vendor payment, it will notify you right away whether or not the payment has been reconciled or not, with the phrase “Reconciled “, followed by the date it was matched/reconciled.

If this phrase is not there, then you have an un-reconciled bank transaction. Simple and easy to follow.

QuickBooks

In QBO, you can never tell if you matched a recorded transaction to your bank account feed.

The screen will show a phrase “online banking matches”.

This phrase makes it appear as though matches exist for this transaction, which could be the case.

But this phrase also could mean that the bank feed transaction has already been matched.

This means you have to click into the details to determine the actual answer.

If QBO had used “Matched” in the phrase to let you know it has been matched, and use “Matched” to alert you that one exists, this would have helped, but alas, it is not what they did.

Curious to find out more about Xero vs. QuickBooks? Stay tuned next week when we tackle the two customized reporting features.

Until next week!