Xero vs. QuickBooks: Designed For The Business Owner

Stop using your parent’s accounting software and join the Xero revolution.

Check out our previous Xero vs. QuickBooks Part I Blog and Xero vs. QuickBooks Part II Blog, and Xero vs. QuickBooks Part III Blog if you haven’t already.

Whether you are a current QuickBooks user looking to make a switch, or are just starting your business and trying to determine which software is right for you, we are here to help.

Most of you have used or heard of the accounting software QuickBooks (QBO).

In America, QuickBooks (QBO) has become synonymous with small business accounting as it has been around for a very long time.

However, since QuickBooks (QBO) was first introduced, technology has continued to improve, and something called the Internet came and introduced us to an entirely different way of working.

In essence, the technology that QuickBooks was built on no longer works for the modern business owner.

Here are 5 main reasons, after 15 years in the industry, that we made the switch from QuickBooks to Xero.

- Xero is cloud-friendly

- Xero has a killer bank recording/reconciliation feature

- Xero allows you to create your own customized reporting

- Xero is designed with you, the business owner in mind

- Xero has unlimited users

In today’s blog, we’re going to dive deeper into reason three – customized reporting.

Xero vs. QuickBooks: Designed For The Business Owner

General structure and navigation

Many accounting software platforms are hard for business owners to learn and use as they are designed, organized, and use language from an accounting point of view.

As opposed to being structured in terms in and language that a business owner would naturally understand.

One example of this is bank reconciliations.

In QuickBooks, bank reconciliations are a part of the Accounting Section in the platform, as technically bank reconciliations are an accounting function. To the QuickBooks developer, this makes sense.

However, a business owner doesn’t think like that.

They simply want to reconcile their bank account, which is why Xero puts this feature in the Bank Account section.

Why would you leave your banking area when you want to do a bank reconciliation?

The answer is you wouldn’t, unless you are grouping activities in more of an accounting function point of view.

This is just one example of how Xero tries to organize and keeps things simple for the average business owner.

Xero speaks to the language of business owners, and makes it easier to navigate to the key functions that business owners will want and need to use.

Categories

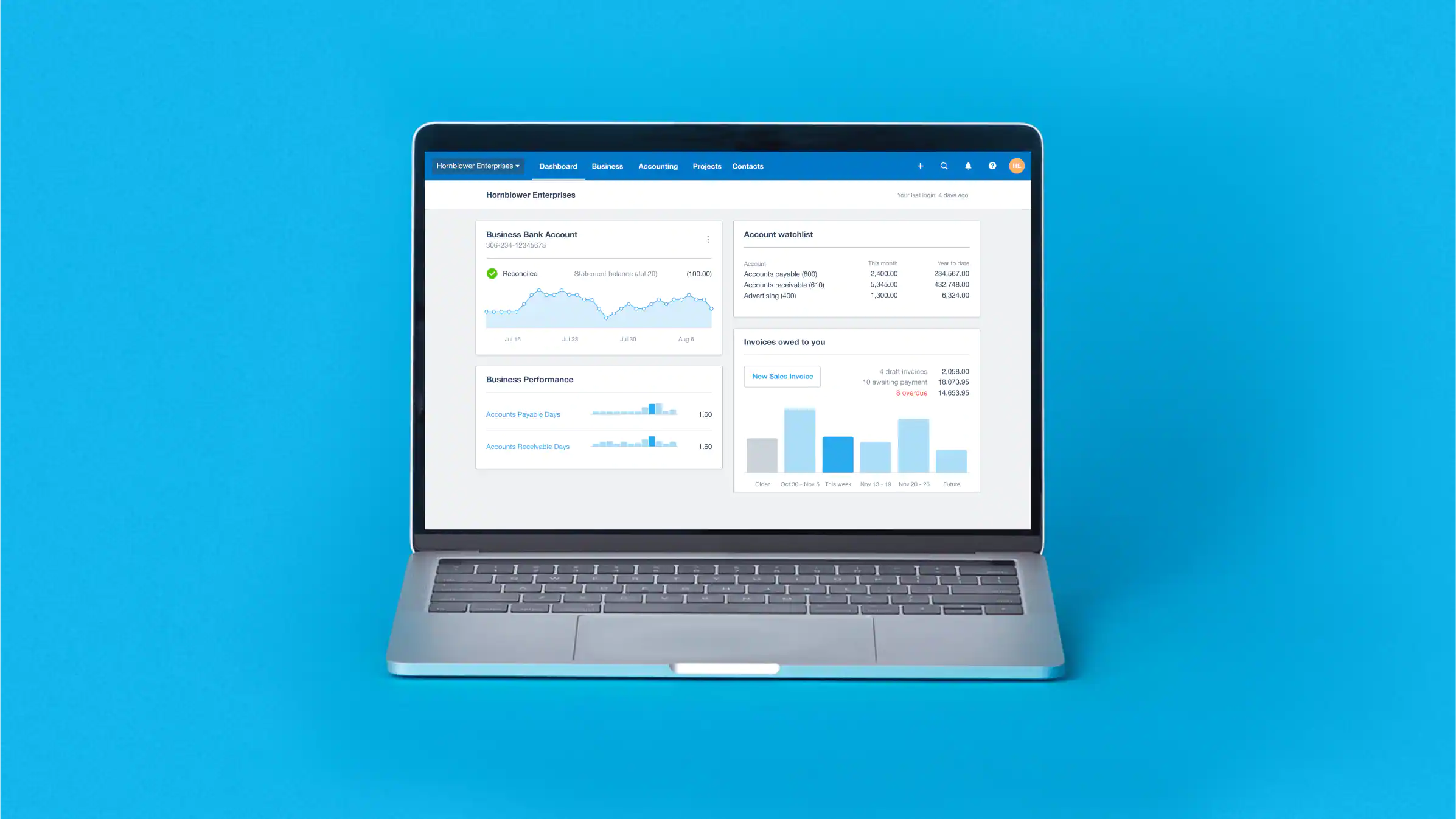

Xero has just 3 simple categories: Business, Accounting and Contacts, all located at the top of the screen.

- Business is where you find all customer and supplier activities

- Accounting is where all reporting and settings are, and

- Contacts are where you can look up your customers and suppliers.

Each of the three categories has their own list, which is easy to navigate in the top-down menu format. Again, keeping things simple and easy to use.

QuickBooks has a much larger and complicated navigation pane (located on the left side) that has about ten categories, each with their own list.

The lists are harder to navigate as you have to hover your mouse over the main category and then move your cursor over to the right to pick from the dropdown list.

And be careful! If you move your cursor too high or low, the lists disappear.

A complicated list followed by a complicated way of navigating it – it’s not the best.

QuickBooks knew their navigation pane needed improvements, and recently announced that they were updating how they organized and grouped the softwares functions.

You can read about it here… just make sure you zoom in about 300% so you can actually read the new layout.

We don’t know how, but we find the new version even more, or just as confusing as the previous iteration.

This only highlights the program’s disconnect from how business owners think and the language they use.

Organization and Structure of “Contacts”

For good reason, Xero and QuickBooks both restrict you from having identical duplicate names.

In Xero, this works just fine as the software doesn’t see customers and suppliers differently.

In Xero, everyone is considered a contact. It is the nature of the transaction that determines whether the contact is then classified as a customer or a supplier.

This allows you to create one name that can be assigned to both bills/payments for expenses, but also invoices/receipts for sales transactions.

It also allows a contact to act as both a customer and supplier, and is quite a unique option that is not seen in other accounting software. If you’re using another accounting platform, you most likely don’t have this option.

The same can be said for QuickBooks – the conceptual framework of a customer and a supplier/vendor are separated into two distinct functions.

This means they are organized into two separate data sets.

If you have a contact name that acts as both a supplier/vendor and a customer, you have to create the same name twice so that all customer-related transactions go to the customer and all purchase-related transactions go to the supplier/vendor name.

If you recall, the software prohibits identical duplicate names, so you have to create that contact twice – once as a customer and once as asupplier/vendor, and spell the name differently.

Ok… but it doesn’t sound like that big of deal does it?

Unfortunately, when it comes to QuickBooks, it becomes a big deal as the name will impact how it gets reported.

In QuickBooks, when you are creating an invoice, you are restricted to only using customer names.

When you create a bill, you are restricted to only vendor names.

However, when you create a payment, there are no restrictions.

If you choose the wrong name and code, the expense payments to the customer name will create an issue.

If you run any vendor reports, those payments incorrectly coded to the customer name will not show up because they have been categorized to a customer name, not a vendor name, which means the data you are looking at is incorrect.

See? A big mess.

These are just a few of the many examples of how unfriendly QuickBooks can be for business owners.

Much of the functionality is simply ill-developed, and not designed for the typical entrepreneur in mind.

Stay tuned next week as we dive into our fifth and final post of the series: the pricing of users.

Have you missed a blog? Go ahead and catch up here!

Xero vs. QBO: Which is Better?

Xero vs. QBO: Bank Reconciliations

Xero vs. QBO: Customized Reporting

See you soon!