How to Calculate Your Restaurant’s Prime Cost

Learn how to accurately calculate restaurant prime cost to boost efficiency and ensure lasting profitability for your restaurant.

Check out our blog for helpful tips, programs we suggest, and new processes to implement into your business so that you level up.

Learn how to accurately calculate restaurant prime cost to boost efficiency and ensure lasting profitability for your restaurant.

Learn when to hire more restaurant staff to improve service and boost customer satisfaction. Get tips on timing and signs to expand your team!

Ask these key questions to your restaurant accountant to assess their industry expertise and if they’re really saving you money.

As summer ends and the demand changes, it’s essential not to overhire. Finding the right balance will help ensure your restaurant stays profitable. So, what should your restaurant labor costs look like year-round? Let’s explore.

Let’s face it: none of us wants to work forever.

Here’s our simple guide to value your restaurant in 2025 and ways to boost its sale price with a few quick changes.

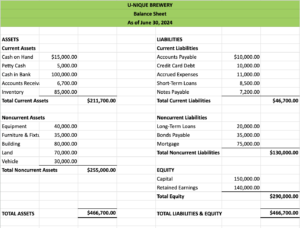

Let’s talk about the Balance Sheet! Here’s everything you need to know about the Balance Sheet for breweries and a handy template for you to use.

Before you switch on that “Open” sign, let’s talk about the nuts and bolts of your restaurant: choosing the right business structure. Here are your options for restaurant business structure in 2025.

There’s a better way to create a restaurant budget in 2025. We’ll chat through the Bottom-Up Approach to budgeting for restaurants, and give you our best tips that you can use in your own business.

When you start thinking about retirement, one of the first questions that comes to mind is: how much is my restaurant actually worth? In this post, we’ll explain the standard EBITDA multiple for restaurants and share tips to increase your restaurant’s valuation.

Nothing in our world stands still, so updating menu prices is as vital as deciding them for the first time. If you’re pricing your menu for the first time in 2025 or it’s simply time for a bit of an update, here’s how to go about it.

Serving too large of a portion can kill your bottom line, while serving too small can leave customers unsatisfied. So, how can you strike the balance between a healthy portion size for both your margins and your customers?

As experienced restaurant accountants who have seen many restaurants succeed… and many restaurants fail… take it from us: accurate restaurant bookkeeping is the key to a successful business.

Let’s get into a few of the most viable retirement options for restaurant owners, and which ones we recommend.

With QuickBooks Desktop subscriptions ending for new U.S. subscribers in July 2024, it’s a better time than ever to transition your bookkeeping from QuickBooks to Xero.

Should you open a restaurant in 2025? Unless you’re willing to commit to these things, we’re not so sure.

In 2025, our choice of top accounting software is Xero for restaurants. In fact, if you’re using QuickBooks Online for your restaurant or bar, you’re missing out on valuable insights that you just can’t get from this software.

In today’s post, we’re going to cover how to calculate the FICA Tip Credit in 2024 for your restaurant or bar, and give you a quick calculator to use to make it easy for you.

Wondering how the R&D Tax Credit for breweries works and how much money you can save?

These 7 brewery tax write-offs can save you tens of thousands of dollars each year.

Your gross profit margin tells you how well you’re doing at making and selling your main product. During inflation, it’s a key metric to look at!