Hiring Employees vs. Temps vs. Contractors for Restaurants

Making the wrong choice, i.e. misclassifying your workers as contractors when they really should be employees, can lead to tens of thousands of dollars in fines.

Check out our blog for helpful tips, programs we suggest, and new processes to implement into your business so that you level up.

Making the wrong choice, i.e. misclassifying your workers as contractors when they really should be employees, can lead to tens of thousands of dollars in fines.

In this blog, we’re going to cover everything you need to know about brewery bookkeeping. What tasks you should be doing every month, the best software to help, and things that you can learn from your bookkeeping each month.

Are you tired of feeling like your restaurant accountant is just punching the clock and going through the motions?

Curious about which software is best for your brewery? Here’s an accountant’s recommendations of the top 5 software for breweries in 2023.

A P&L statement shows the income and expenses of a business over a given period of time. It also shows where those profits came from. In this guide, we will share with you the role of your restaurant’s P&L statement and why it matters.

QuickBooks has been a popular accounting software option for many small businesses, including restaurants. However, as the restaurant industry has evolved and become more complex, QuickBooks may no longer be the best solution. Here’s why…

Are you curious about how your restaurant’s financial performance is being tracked? The Balance Sheet is one of three essential financial statements that can help you understand your business’s worth. Find out why it matters for all restaurant owners.

The restaurant industry is one of the most demanding working environments, requiring full-time per week. Question is, can your restaurant shift to 4-day workweek?

In today’s blog, we’re going to go over what the chart of accounts is, why you need one, and how to create a chart of accounts for your brewery.

Can you switch accountants during tax season? With U-Nique Accounting, the answer is YES!

Free Template Included! What if we told you that you’ve been budgeting for a company all wrong? Here’s how to budget for a company the right way and…

Do you own a restaurant? We’re 99.% sure you qualify for thousands of dollars back with the Employee Retention Credit for restaurants.

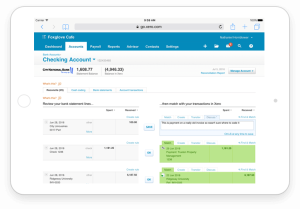

We recommend all of our restaurant business owners open multiple checking accounts to manage the various expense accounts in their business. Here’s how to do it.

I’ve learned quite a lot of business tips from Dude Perfect. As an experienced accountant, these are the things I learned about my business from Dude Perfect, and will apply to yours as well.

Adjusting prices is a common part of doing business, especially as your business grows. If your prices do not increase, at least as much as inflation and other factors, your company’s financial health may be impacted.

A Vendor Early Payment Discount sounds attractive, doesn’t it? Unfortunately, this isn’t always the best choice for your company! Read more and learn why.

Brex fired thousands of small business customers in June 2022. But here’s the good news. There’s a better banking platform alternative that we recommend even more.

Overpaying is common for business owners and unfortunately, it has the same effect as throwing money down the drain. Here’s why your business needs tax planning to pay as little as legally possible.

Curious which accounting software an experienced accountant prefers? I think you’ll be surprised! Here’s our Xero vs. QBO review.

When contemplating whether to use Xero vs. QuickBooks for your accounting software, it’s important to look at the user licensing and how the pricing will affect your small business.