Balance Sheet & P&L: Like Peanut Butter & Jelly

Balance Sheet & P&L: These two financial statements go together like peanut butter & jelly. But what’s the missing ingredient?

Check out our blog for helpful tips, programs we suggest, and new processes to implement into your business so that you level up.

Balance Sheet & P&L: These two financial statements go together like peanut butter & jelly. But what’s the missing ingredient?

I’ve learned quite a lot of business tips from Dude Perfect. As an experienced accountant, these are the things I learned about my business from Dude Perfect, and will apply to yours as well.

When done properly, cash flow forecasting becomes one of the most important tools in your financial toolbelt for helping you run your company.

Adjusting prices is a common part of doing business, especially as your business grows. If your prices do not increase, at least as much as inflation and other factors, your company’s financial health may be impacted.

A federal program called the state small business credit initiative (SSBCI) has finally started distributing committed funds totaling $10 billion to small businesses across the country.

A Vendor Early Payment Discount sounds attractive, doesn’t it? Unfortunately, this isn’t always the best choice for your company! Read more and learn why.

Brex fired thousands of small business customers in June 2022. But here’s the good news. There’s a better banking platform alternative that we recommend even more.

Overpaying is common for business owners and unfortunately, it has the same effect as throwing money down the drain. Here’s why your business needs tax planning to pay as little as legally possible.

Curious which accounting software an experienced accountant prefers? I think you’ll be surprised! Here’s our Xero vs. QBO review.

When contemplating whether to use Xero vs. QuickBooks for your accounting software, it’s important to look at the user licensing and how the pricing will affect your small business.

When contemplating whether to use Xero vs. QuickBooks for your accounting software, it’s important to look at how functional and intuitive it is for the end user.

Manufacturing and distribution businesses are currently experiencing unique challenges as inflation continues to impact the economy.

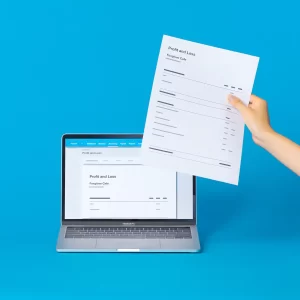

Some would argue that QuickBooks Online wins out in this category, but we beg to differ. Here’s why we prefer Xero’s customized reporting feature to QBO.

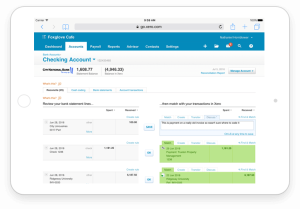

Xero vs. QuickBooks – which is better when it comes to bank reconciliations? We’re walking you through the pros and cons of both in today’s blog.

Xero vs. QuickBooks Online – which should you choose? We walk through key points to think about when determining which accounting software to use.

I took my first Spring Break trip in 15 years this year with my family. Here’s what I learned as a business owner about pricing from the world-class organization.

I took my first Spring Break trip in 15 years this year with my family. Here’s what I learned as a business owner about customer experience from the world-class organization.

Budgeting vs. forecasting: what’s the difference? We’ll get you a hint! You can go ahead and throw one away.

How you ever wondered what is on a balance sheet? In this blog, we’re going to break down exactly what’s on a balance sheet, how it’s calculated, and why you should be reviewing it as a business owner each month.

One of the most proactive measures you can take is making adjustments to your budget.